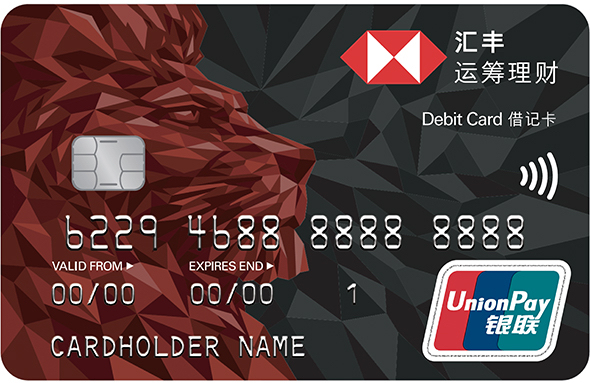

HSBC Advance Debit Card

-

Attentive and preferential treatment

-

One-stop solution for local and foreign currency accounts

-

Greater convenience for cash withdrawals in China and overseas

-

Free and flexible management of funds

Contact us

HSBC Advance customers

Other customers

400-820-3090 (8:30-17:30, Mon - Fri, holidays excluded)

Please dial the country code of mainland China +86 if you are calling from overseas, Hong Kong SAR, Macau SAR, or Taiwan

Benefits

- Attentive and preferential treatmentEnjoy discounts on shopping and dining as well as other privileges with your HSBC Advance Debit Card. There are no transaction fees on cash withdrawals at HSBC China ATMs and no annual fee.

- Greater convenience for cash withdrawals in China and abroad

Within China, you can withdraw RMB from your RMB account through HSBC China ATMs, or from your RMB primary account through UnionPay network ATMs.

Outside of China, you can withdraw the local currency through UnionPay network ATMs from the RMB primary account linked to your card. If you've already opened a foreign currency account and linked it to your debit card, you can also withdraw money through HSBC ATMs (except in Taiwan).

In Hong Kong SAR(Hong Kong Special Administrative Region), you can withdraw the local currency from the RMB primary account or the foreign currency account linked to your card through HSBC ATMs (with the UnionPay logo).

- One-stop solution for local and foreign currency accountsLink up to three local accounts. The primary account should be an RMB settlement account and the two supplementary accounts can be either RMB or foreign currency accounts. You can adjust the supplementary accounts whenever you want according to your needs.

- Free and flexible management of funds

Say goodbye to a bulging wallet full of cash. You can use your HSBC Debit Card at millions of domestic and overseas payment terminals affiliated to the UnionPay network.

Make online payments conveniently with your HSBC Debit Card via UnionPay. You can pay for online purchases around the world, including utility expenses, mobile phone bills, credit card debt, transportation, business trips and charitale donations.

You can also apply to be an HSBC Premier customer to enjoy international recognition and privileges, plus exclusive international and domestic value-added services and many other offers.

Apply

For new customers to HSBC China (if you do not have any accounts with HSBC China)

Smart account opening

To open an account, simply scan the QR code, or click the image if you are browsing on mobile devices. Please read our guide for details and support (in Chinese only).

Make an appointment

Leave your contact details with us and we'll be in touch in 1-2 business days

Call us

(8:30-17:30, Mon - Fri)

Please dial the country code of mainland China +86 if you are calling from overseas, Hong Kong SAR, Macau SAR, or Taiwan

For existing customers of HSBC China (if you have at least one personal account with HSBC China)

1. Fill in the following form*

2. Apply at our branch with the completed forms. You will also need to bring a valid identification document (original).

3. Your debit card will be sent to the correspondence address held by the bank within approximately 10 working days (subject to postal delivery time) after your application.

4. If you've already set a PIN for your debit card via tablet during the application process, you can use the card right away upon receiving your card.

If not, please bring the card and your original identification documents, and visit us at the designated branch (usually the branch where you applied for your debit card) to get a PIN.

* If you don't have an RMB settlement account with our bank, please open it first according to the account opening process.

Charges

Tariff table (Unit: RMB)

| Item |

HSBC Advance Debit Card (for Advance customer) |

|---|---|

| Annual fee |

Free |

| Loss report |

Free |

| New card replacement |

Free |

| Balance enquiry (in and outside China) |

Free |

| ATM cash withdrawals in Mainland China (per transaction) | Free |

| Overseas HSBC Group ATMs |

RMB20 or equivalent+1% of withdrawal amount (Max: CNY 110 or equivalent) |

| Overseas China UnionPay ATMs |

RMB20 or equivalent+1% of withdrawal amount (Max: CNY 110 or equivalent) |

Notes:

- Surcharges may be charged by the acquiring bank for cash withdrawal at some ATMs outside mainland China. For specific charging standards, please refer to the information shown on local ATM screen or contact the acquiring bank.

- The withdrawal amount and the service fee will be debited from your withdrawal account once. The service fee for fund transfer from Multicurrency Notes Savings to Multicurrency Exchange Savings through HSBC Advance Debit Card, which is 1% of the fund transfer amount, will also be debited from the corresponding account once

Payment & Security

UnionPay Online Payment

Make online payments conveniently with your HSBC Debit Card via UnionPay. You can pay for online purchases around the world, including utility expenses, mobile phone bills, credit card debt, transportation, business trips and charitable donations.

Apple Pay

HSBC Bank (China) Co., Ltd. provides a new mobile payment solution for HSBC China debit card holders to support Apple Pay services enabling secure and fast payments.

Security tips

Debit card user security tips.

Related products

Permier Debit Card

Enjoy a Premier experience with our dedicated and personalised support.

Deposits

HSBC China offers you a wide range of quality savings accounts and time deposit products and services, empowering you to accumulate and manage your wealth with ease.

HSBC Advance

At HSBC, we'd never claim to play a starring role in your successes, but we're here to support them in every way we can.

Ways to Bank

Banking with HSBC is easy, whether you're at home, in the office or on the move. We offer mobile, phone and online options, so you can choose which suits you the best.