*Please refer to the app interface and functionality as the most accurate version of mobile banking service

How can I register for mobile banking?

1. Download the HSBC China Mobile Banking app from the app store

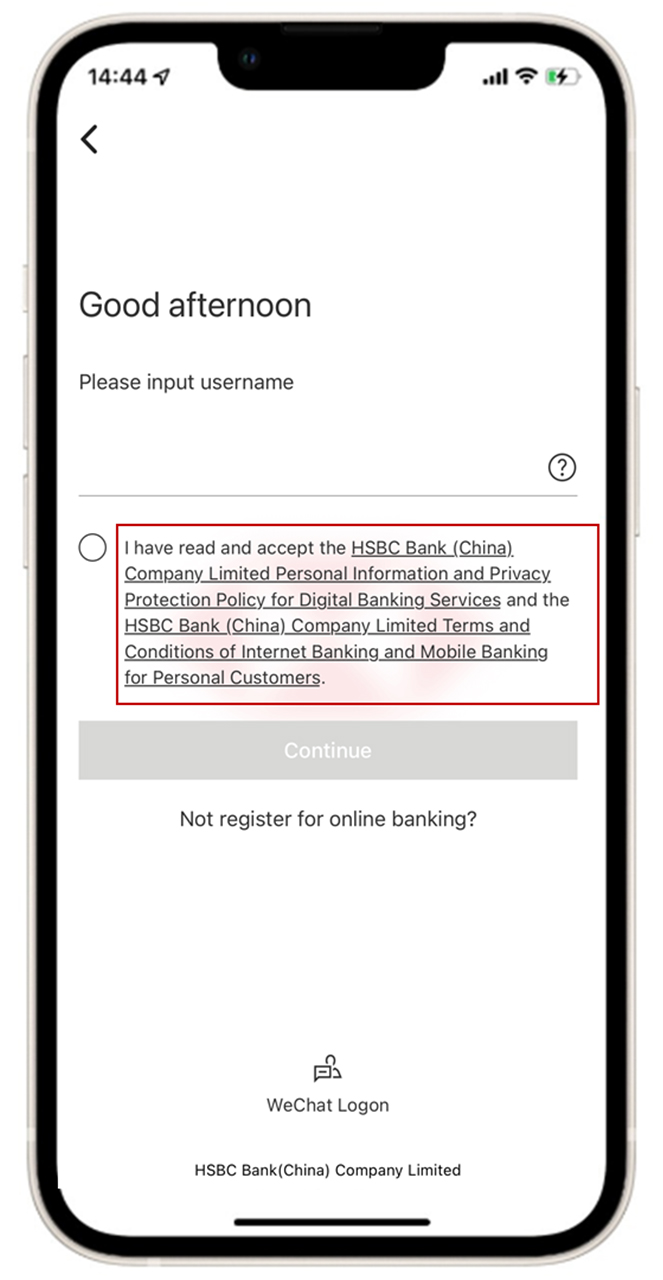

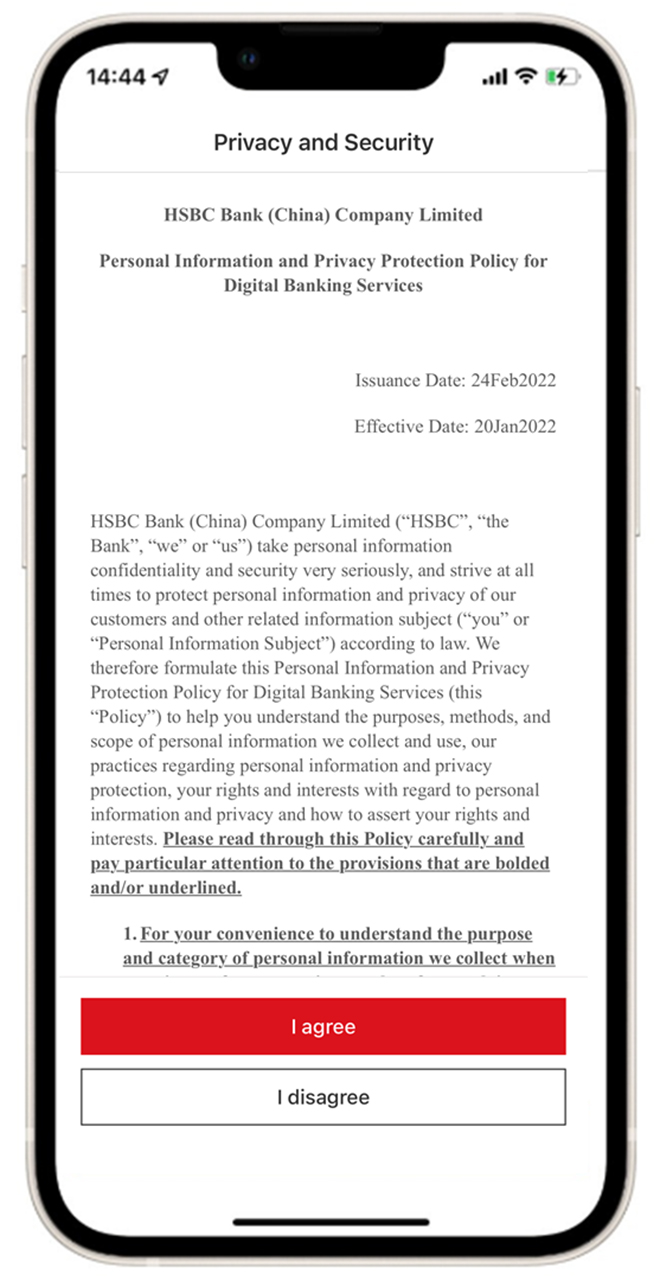

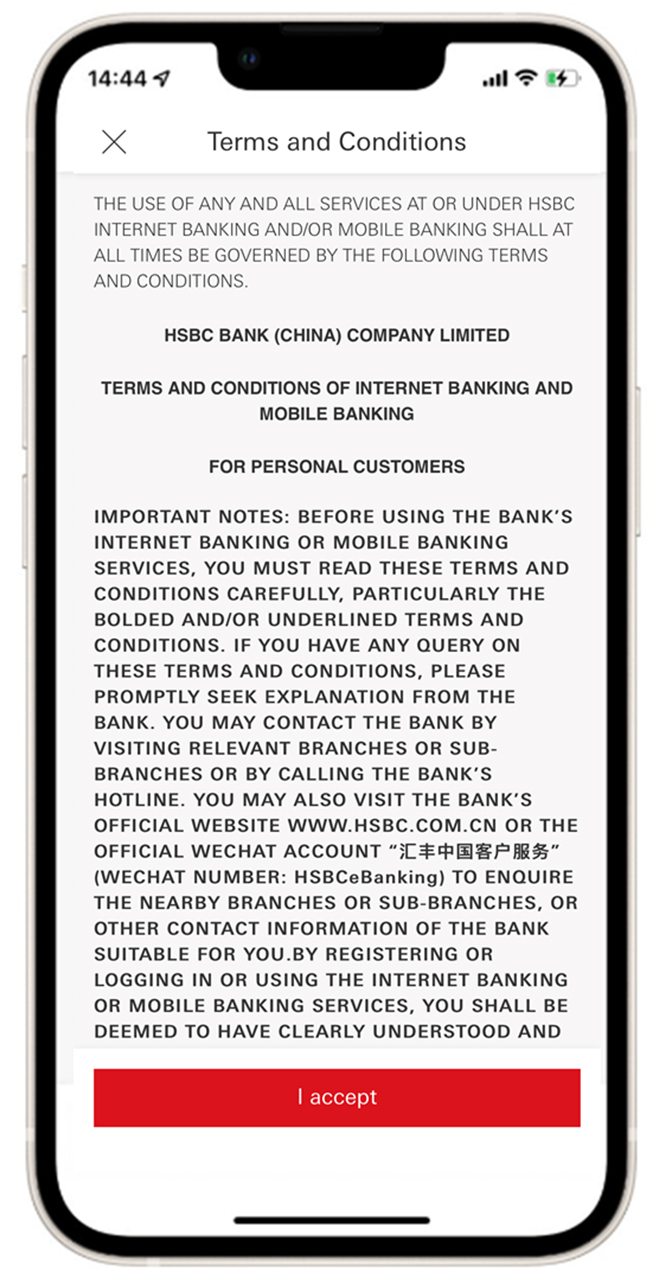

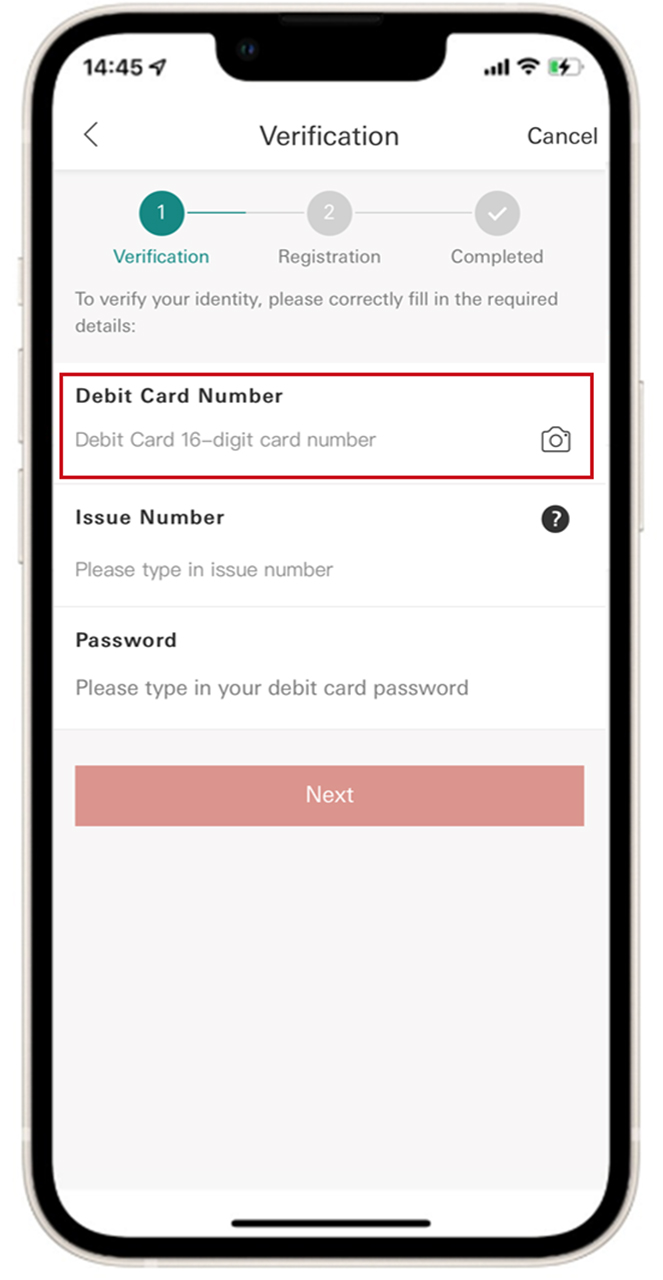

2. Read and accept the terms and conditions according to system prompt, tap 'Register'

3. Get ready your HSBC China debit card or phone banking information, and fill in your corresponding password for identification. You can then begin your mobile banking journey

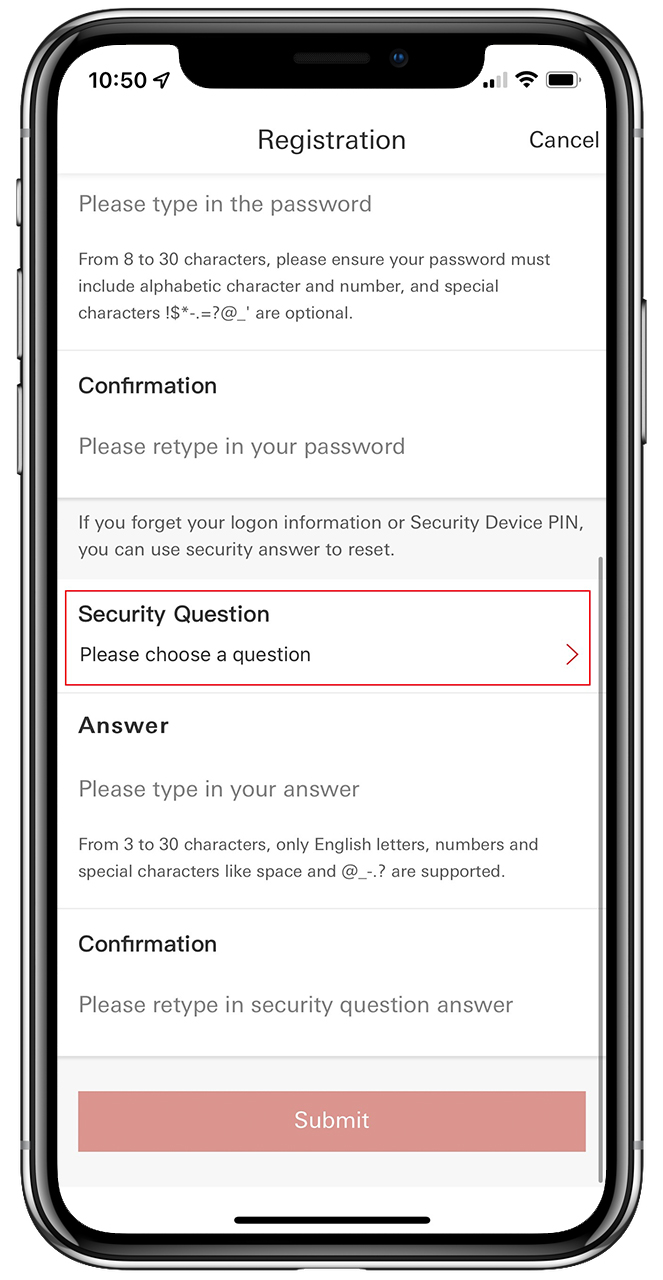

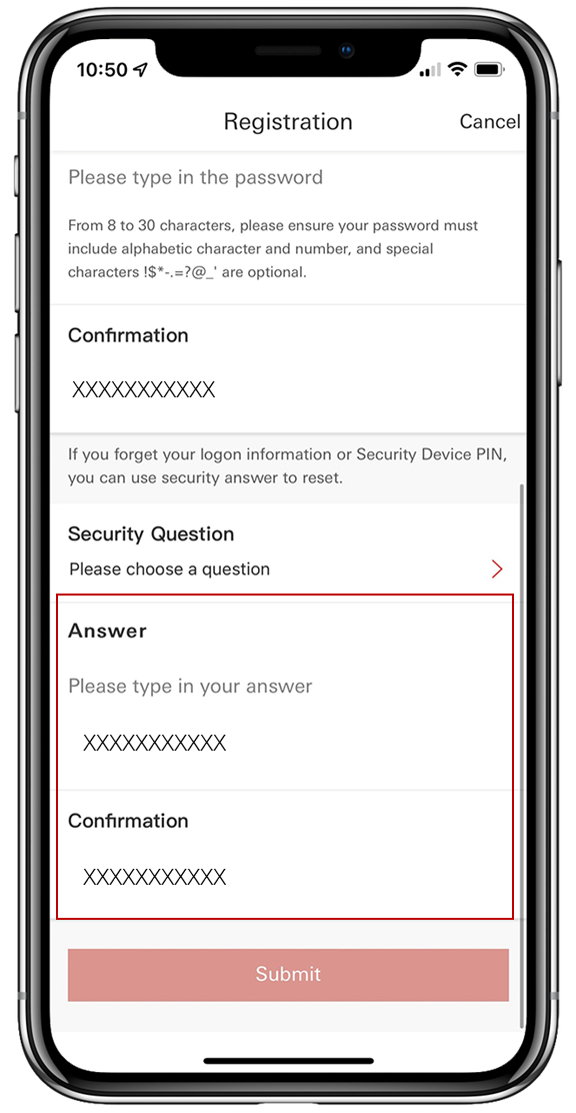

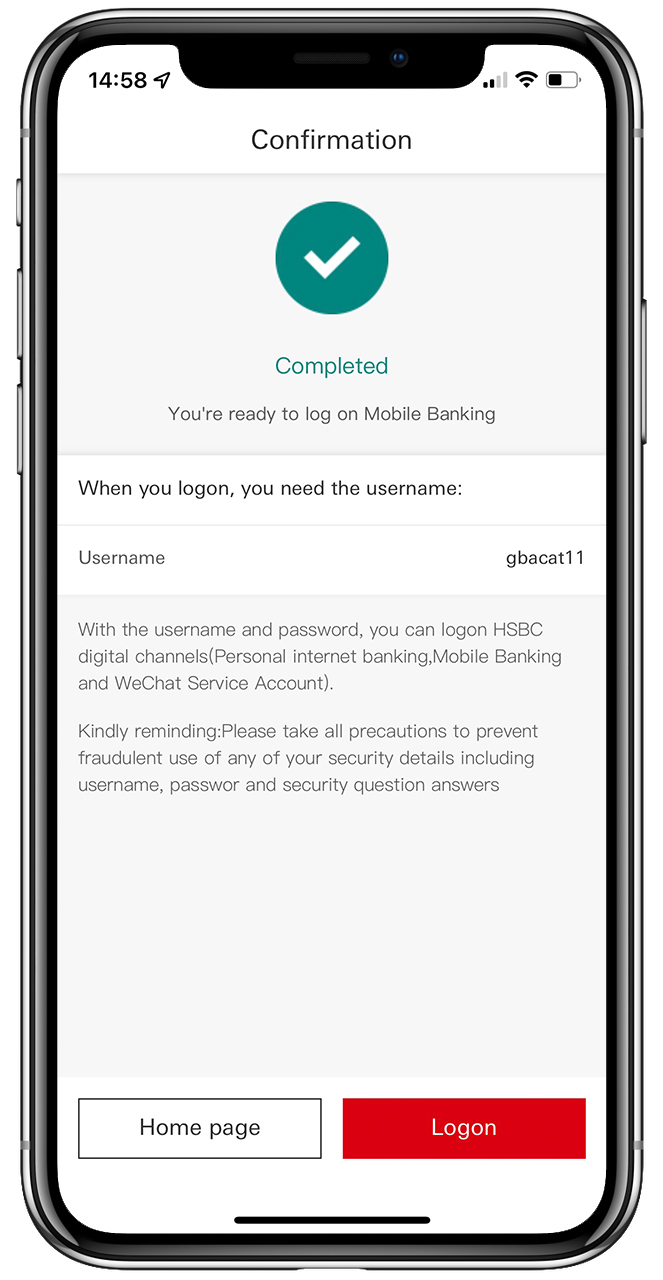

4. Set up your log on password and security question. You will need them for authentication purposes when you reset the credentials on mobile banking

How can I log on to mobile banking?

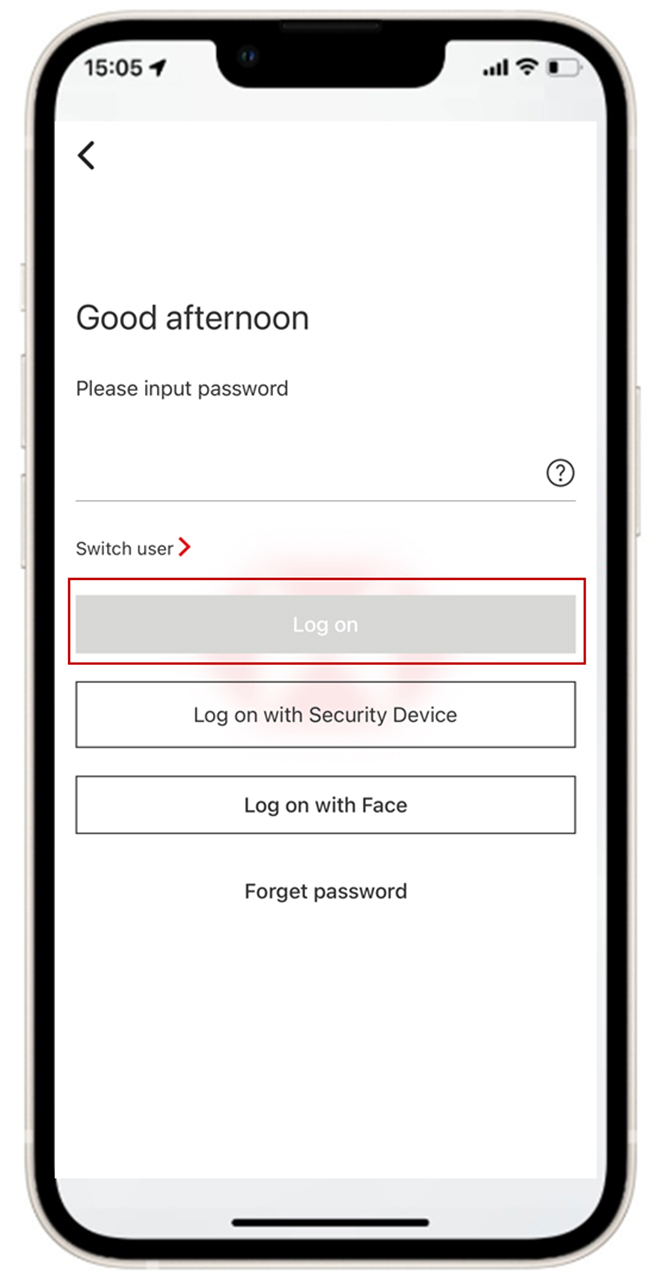

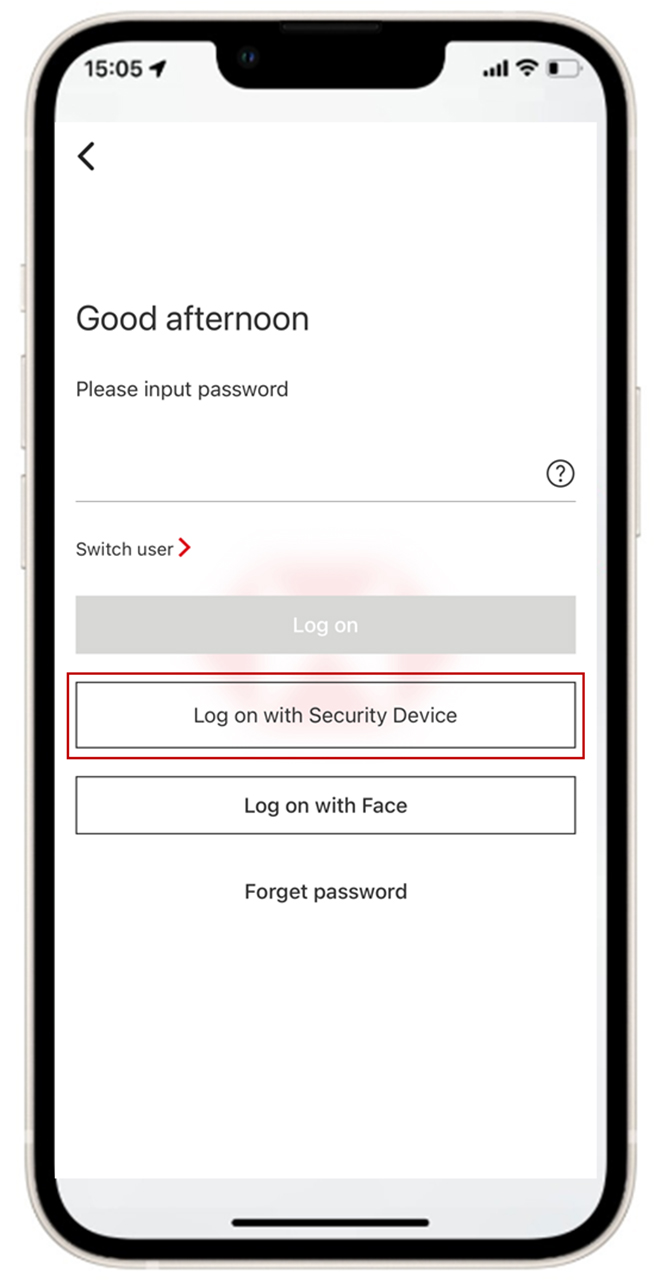

Option 1: Enter your username and password

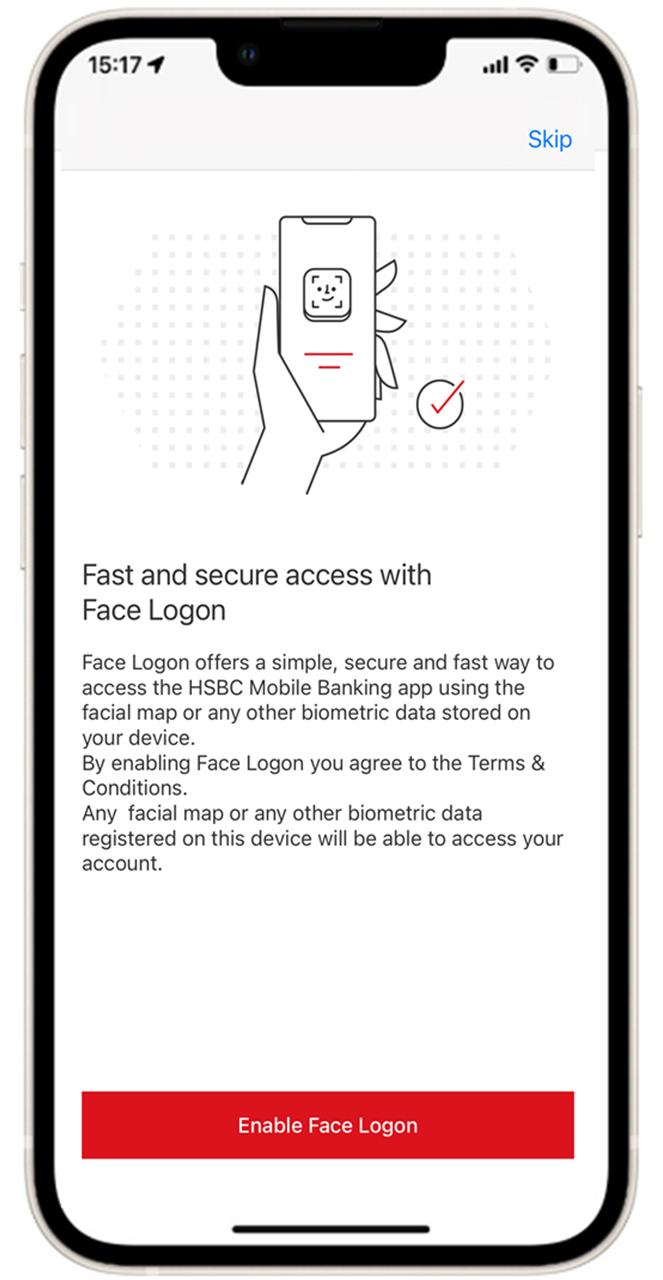

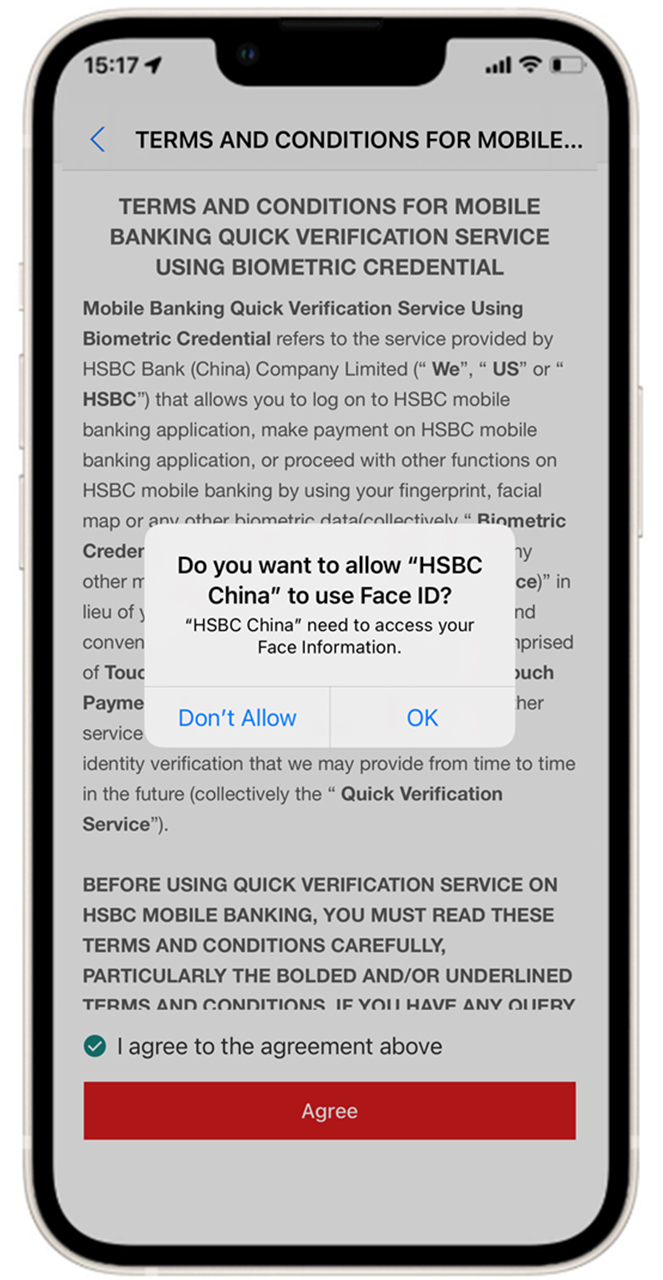

Option 2: Enter your username and use biometric authentication (finger print identification or face recognition)

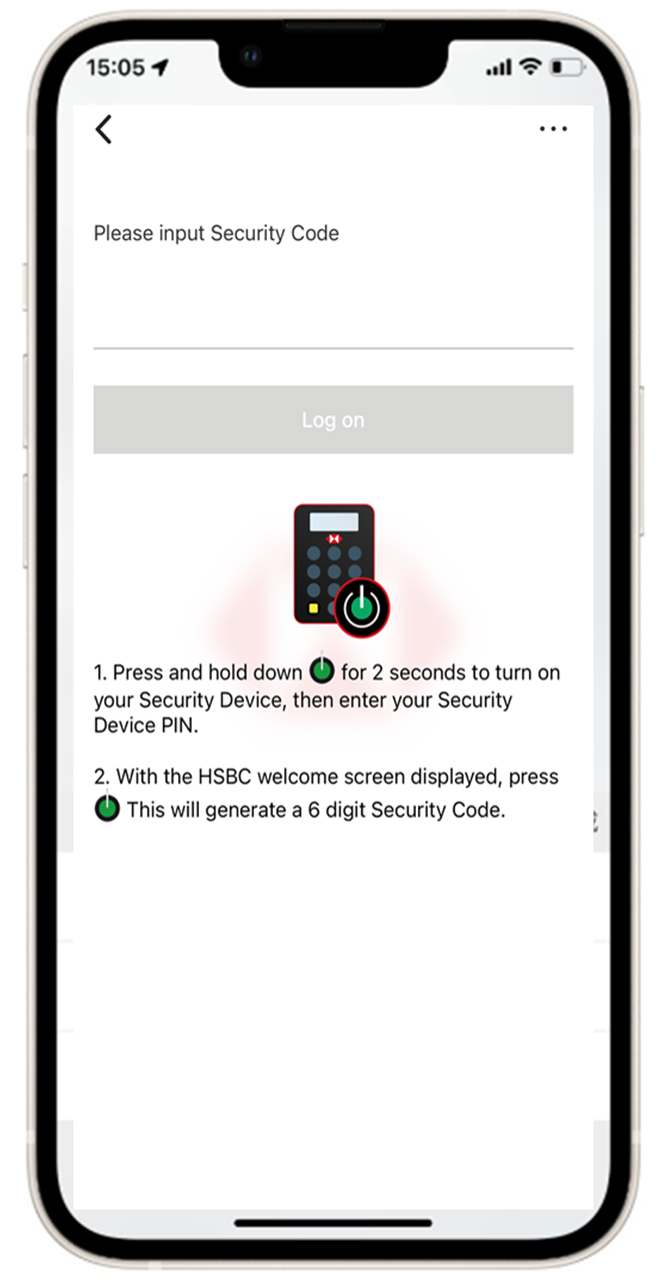

Option 3: Enter your username and use your Security Device

Forgotten your username?

Please call our 24 hour-hotline on 95366 (dial the +8621 China country code if you're calling from abroad) and we'll take care of it.

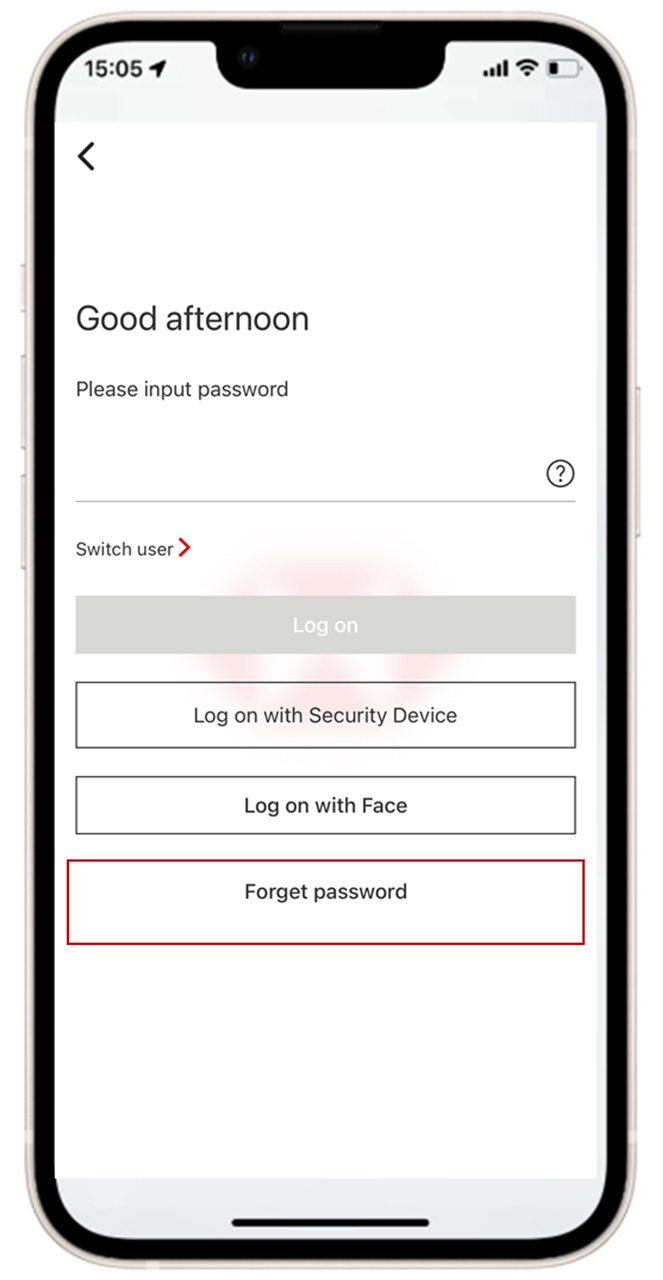

Forgotten your password? / How can I reset my password?

If you forgot your password for Mobile Banking, you can use your HSBC Security Device to log on

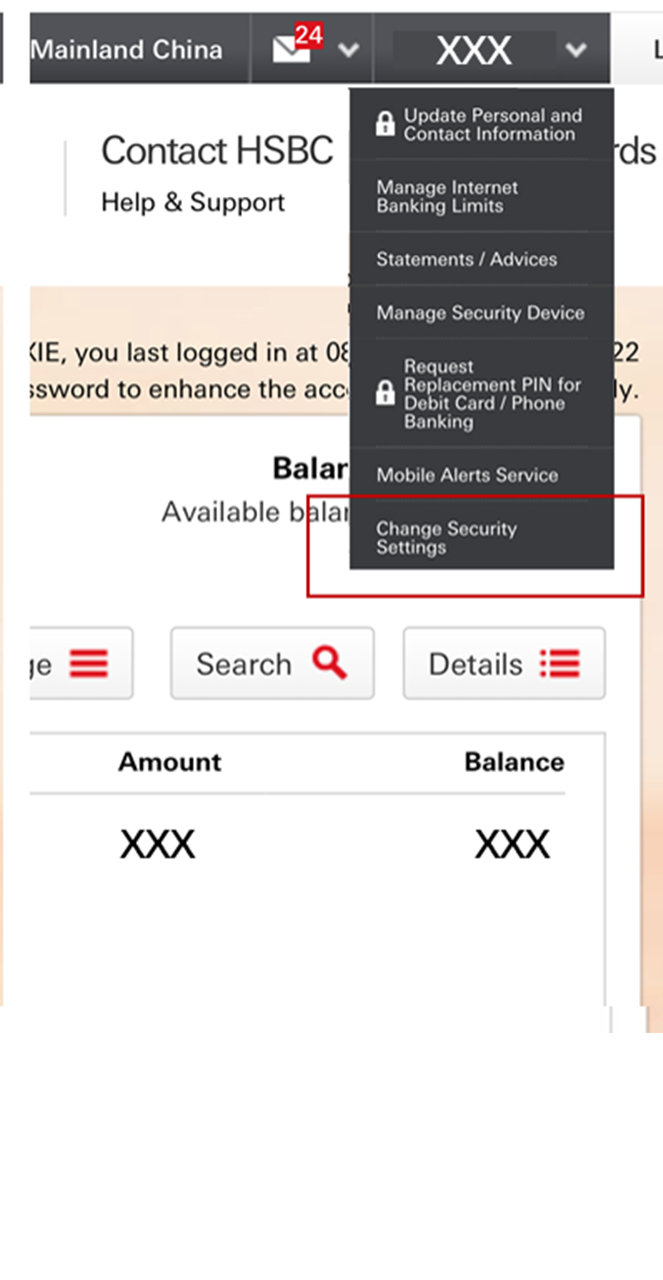

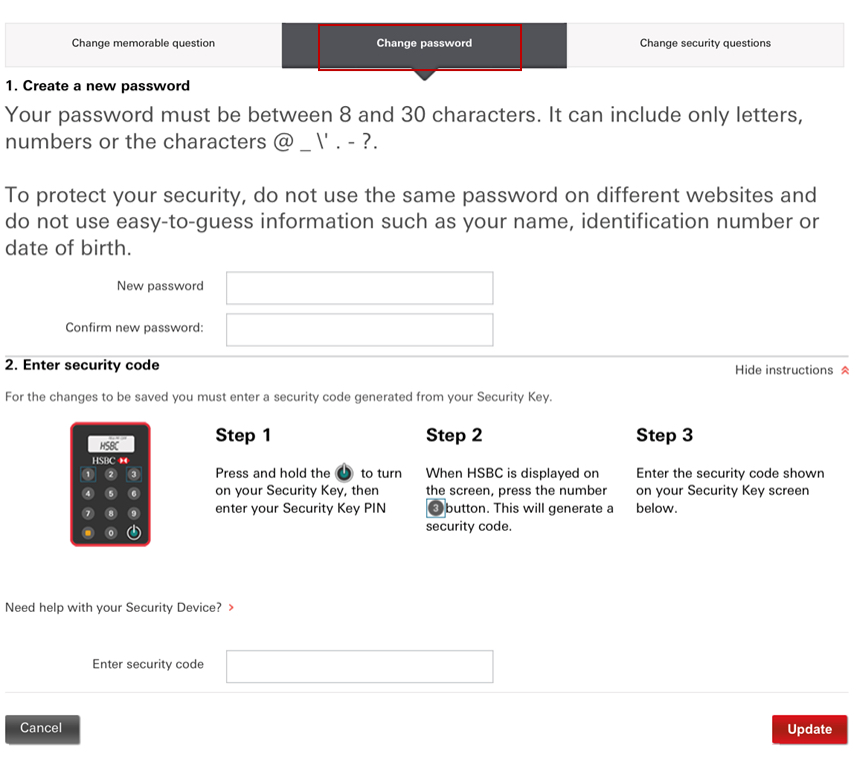

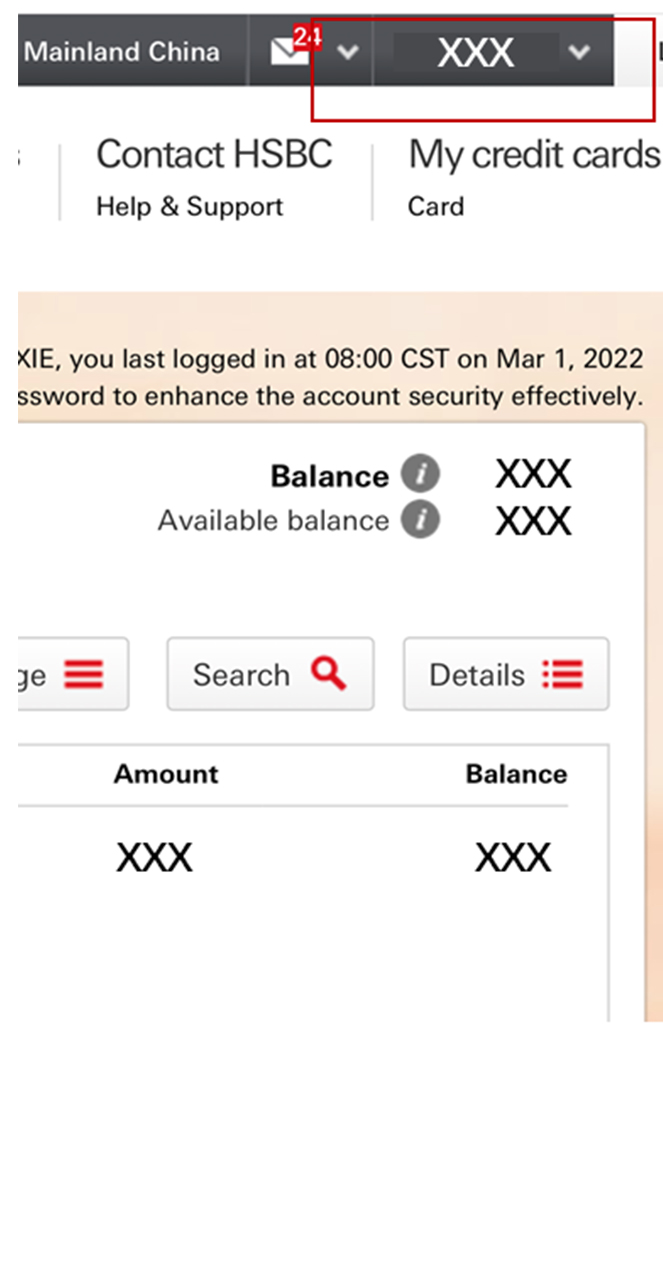

If you need to reset your password, you can tap 'Forgotten password' on HSBC Online Banking and use your Security Device to log on. Find 'Your name' (such as 'San Zhang') on the top of navigation bar, tap 'Change security settings', and then select 'Change password' to change or reset your password

If you forgot your password for mobile banking, and your Security Device is lost, stolen or damaged, please call our 24 hour-hotline on 95366 (dial the +8621 China country code if you're calling from abroad) to apply for a new Security Device

*To safeguard your account and for security purposes, you should make it a habit to change your password frequently.

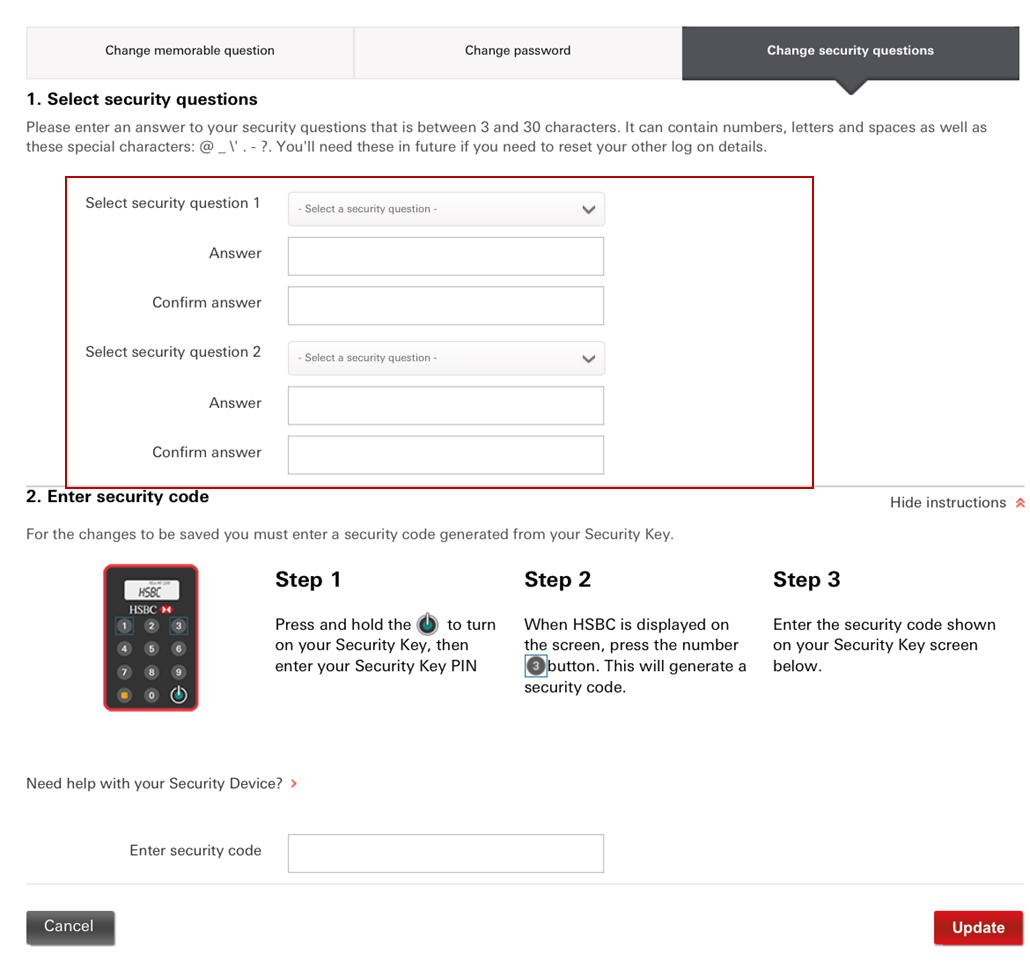

Forgotten your security question / How can I reset my security question?

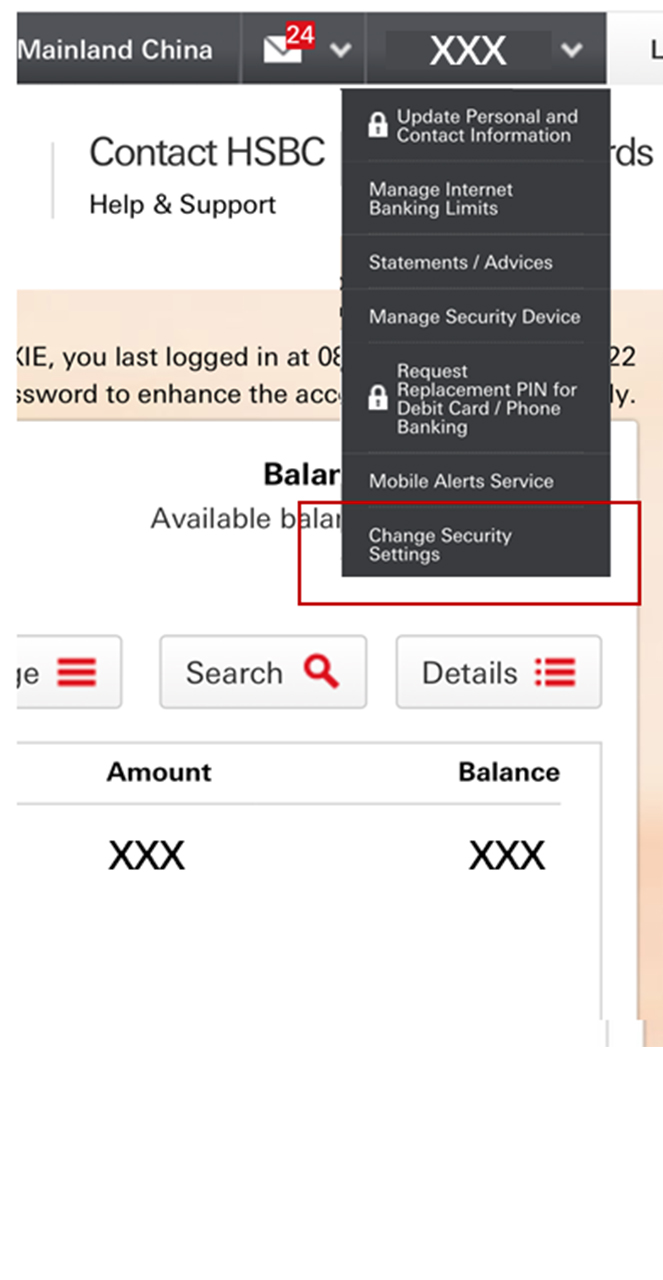

If you forget your security question or need to reset your security question and its answer, you can use your Security Device to log on to the HSBC Online Banking (https://www.hsbc.com.cn/en-cn/). Find 'Your name' (such as 'San Zhang') on the top of navigation bar, tap 'Change security settings', and then select 'Change security question'. You can now choose a new security question and fill in the corresponding answer.

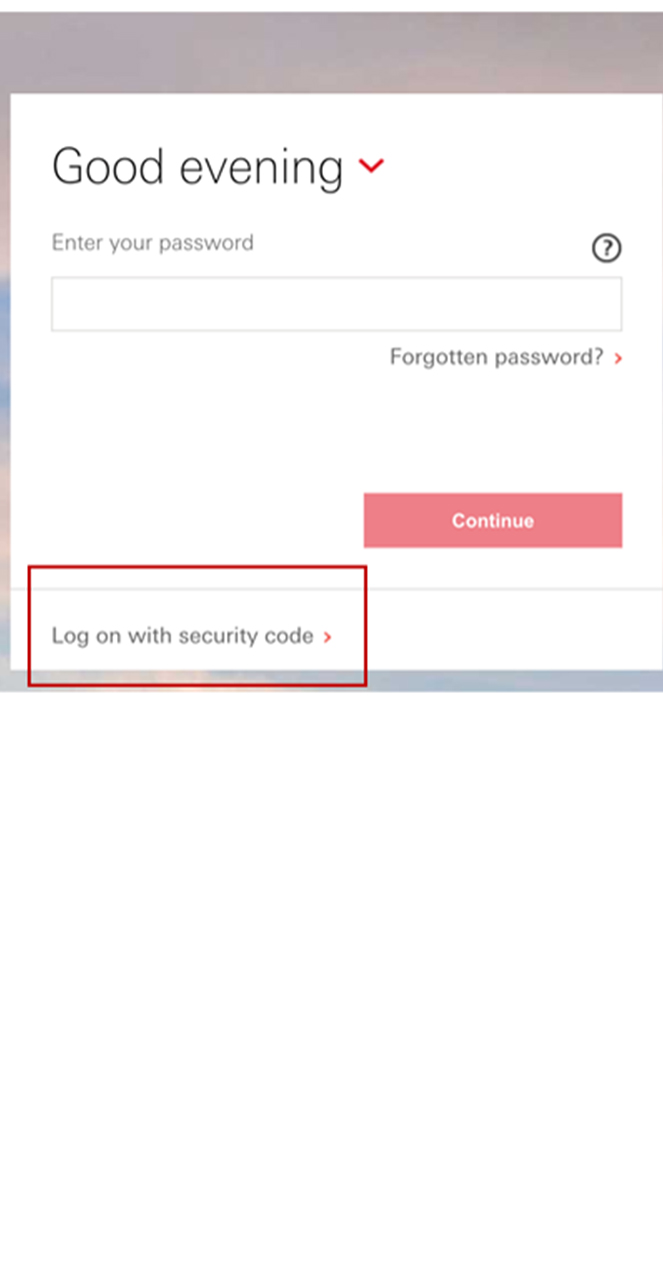

Forgotten your Security Device PIN?

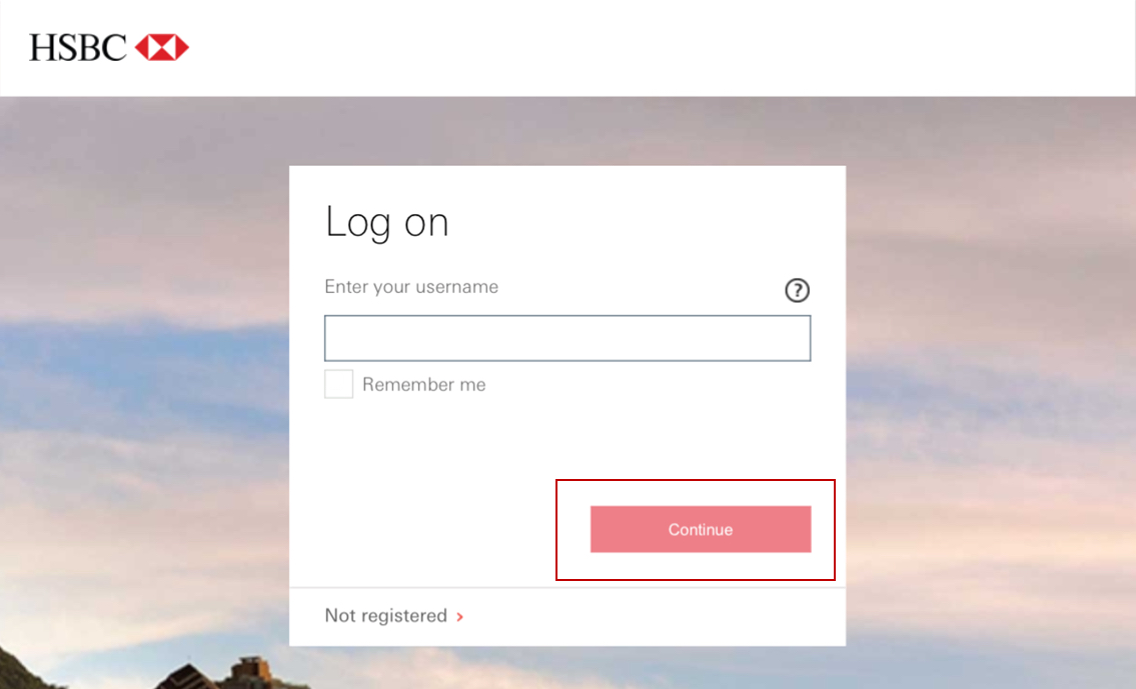

Please log on to HSBC Online Banking (https://www.hsbc.com.cn/en-cn/), fill in your username and select 'Continue' then 'Use Security Device PIN'. A pop up will appear with the option 'Forgotten Security Device PIN?'. Simply select that option and follow the instructions to complete your password reset.

Note: You only have three chances to fill in the answer to security question. If you fail at the third time, you must go to a branch in-person and reset all of the security information.

Your Security Device is lost, stolen or damaged

If your Security Device is lost, stolen, damaged or you need a new Security Device, please follow the steps to unbind the original Security Device and apply for a new one as below:

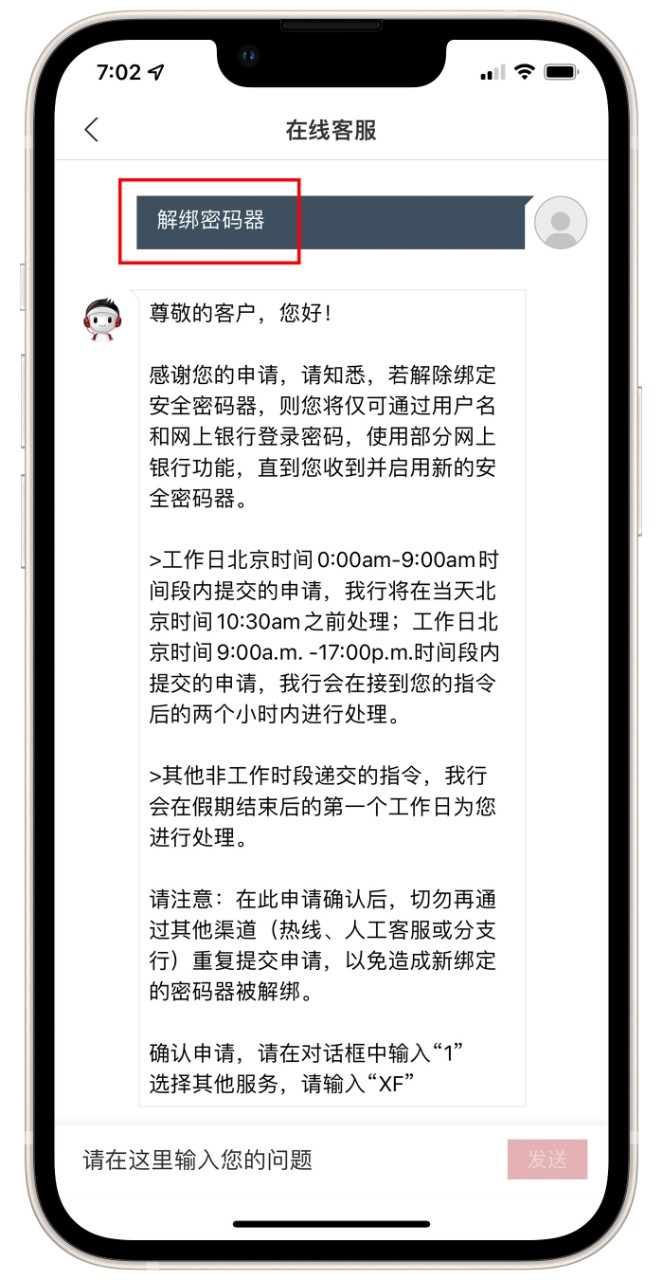

Log on to the HSBC China Mobile Banking app and select the earphone icon. Then input 'Unbind Security Device' directly in the chat box

If your Security Device is lost, damaged or stolen, and you also forgot your mobile banking password, please call our 24 hour-hotline on 95366 (dial the +8621 China country code if you're calling from abroad) to apply for a new Security Device

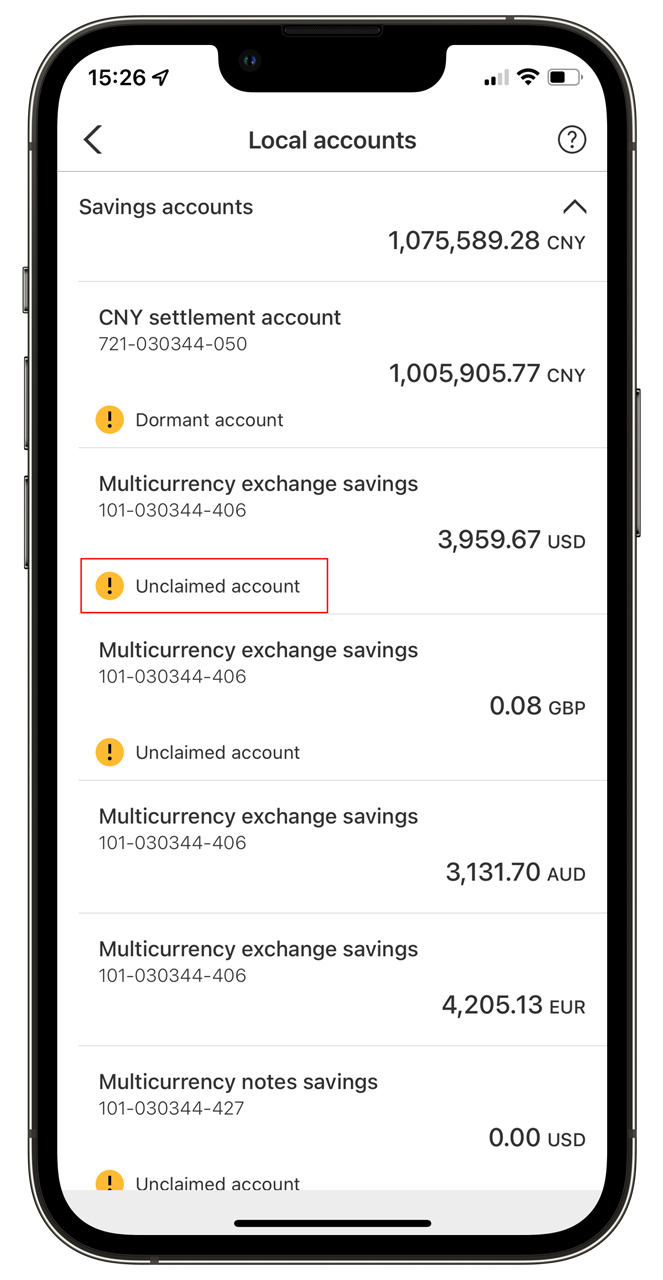

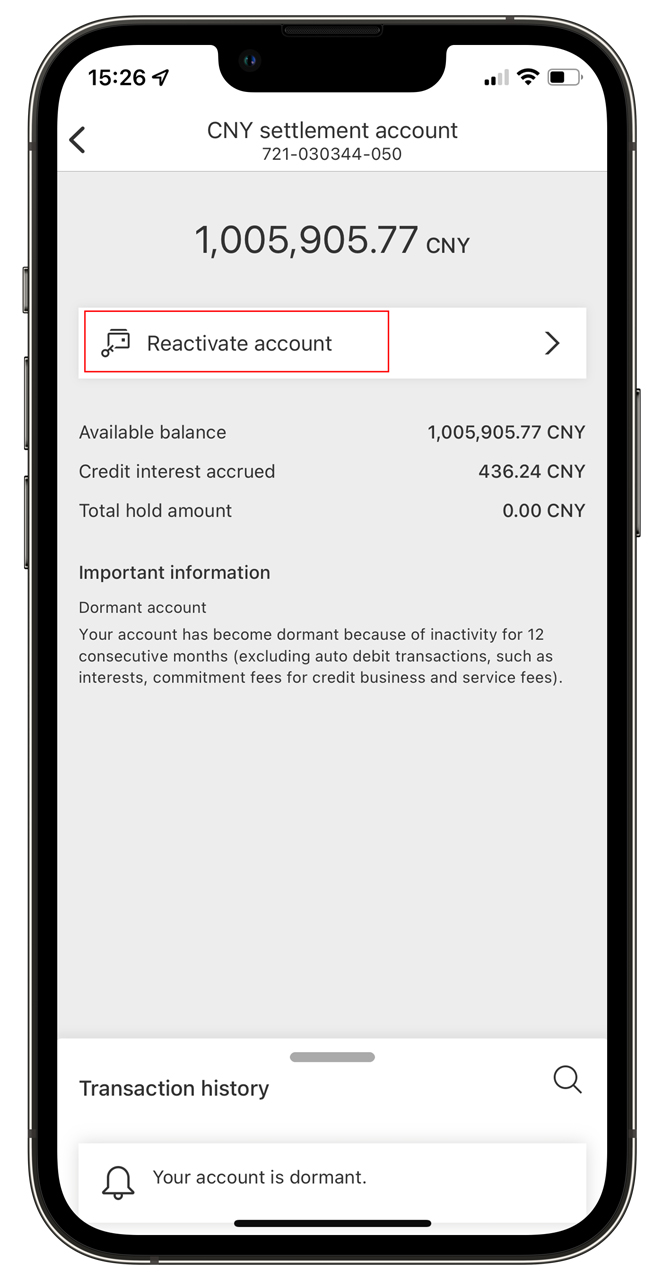

Online reactivation for dormant or unclaimed accounts

If there are no charges for 12 consecutive months on your account, it will be categorised as an 'Inactive account'.

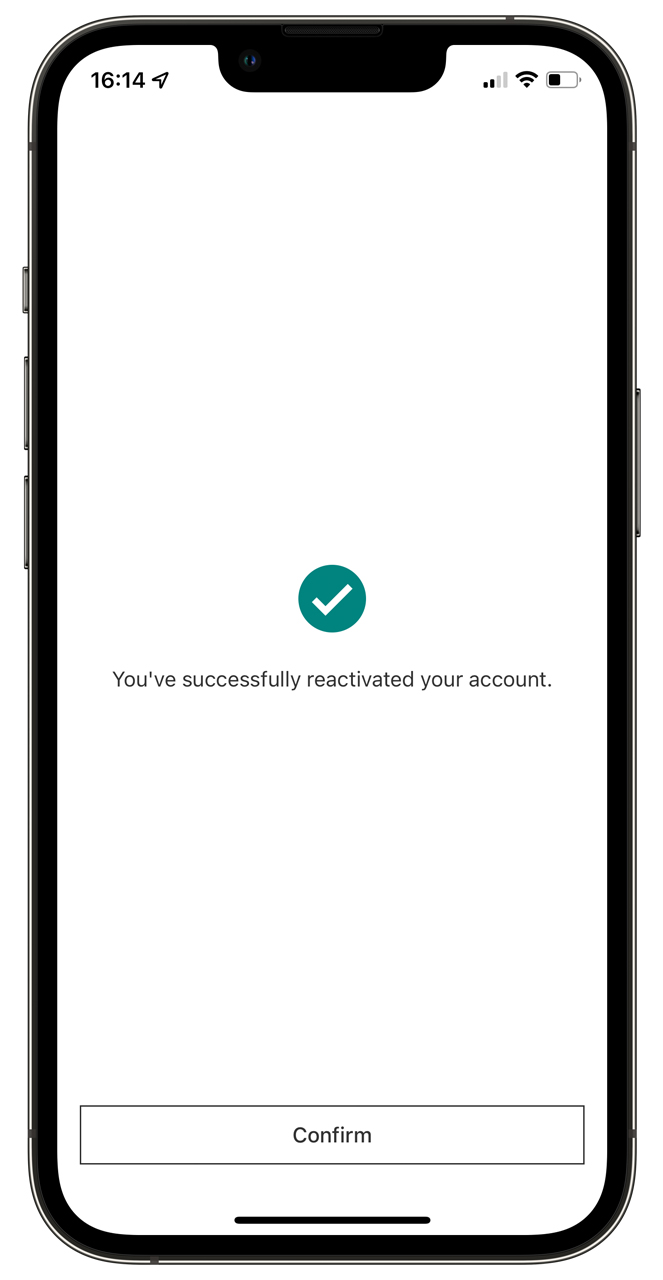

You can log on to the HSBC China Mobile Banking app, check the corresponding account and click on 'Reactivate'.

If you find all accounts you are holding are unclaimed, please call our 24 hour-hotline on 95366 (dial the +8621 China country code if you're calling from abroad) or visit one of our branches with your ID card to reactivate your accounts.

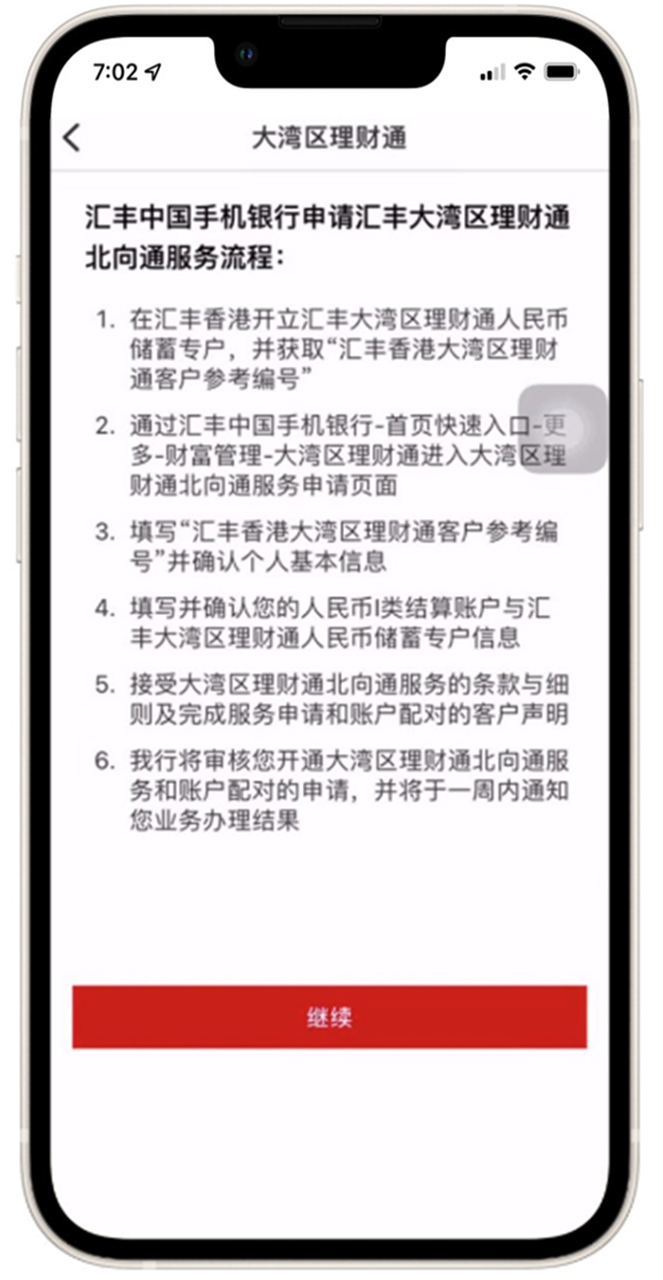

How to open an HSBC GBA Northbound Wealth Management Connect Account via mobile banking?

1. Make sure that you already have a CNY Settlement Account Type I with us and set it as your dedicated account for HSBC GBA Northbound Wealth Management Connect Services

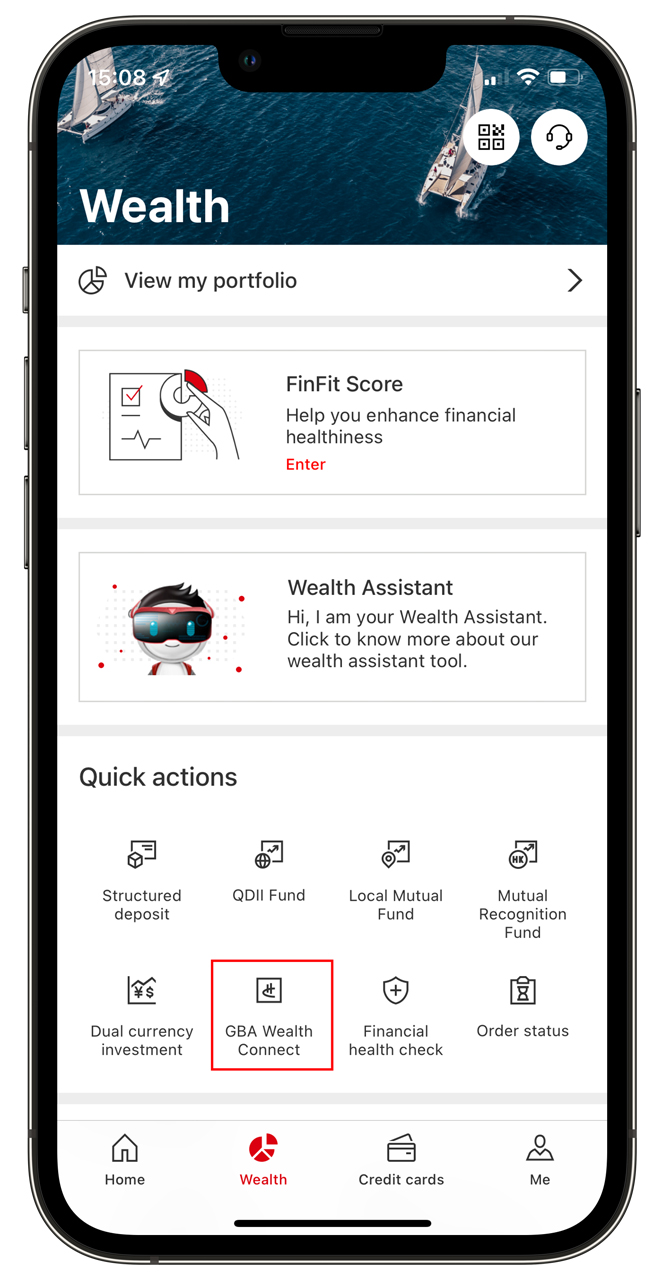

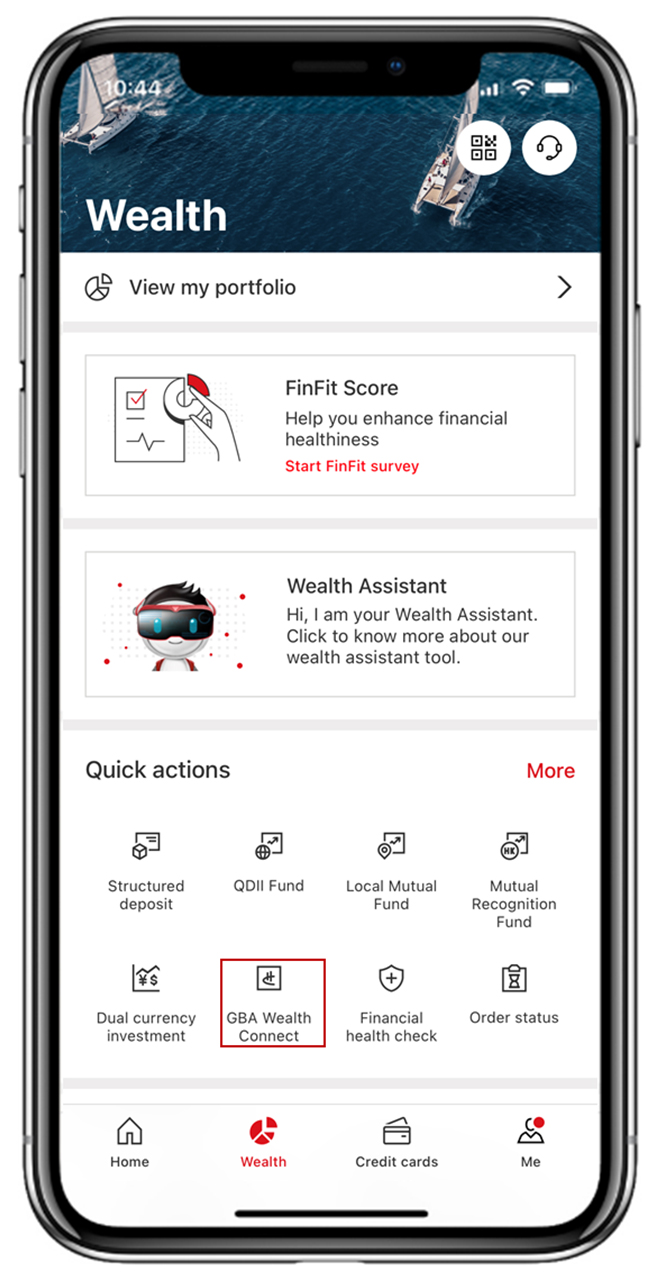

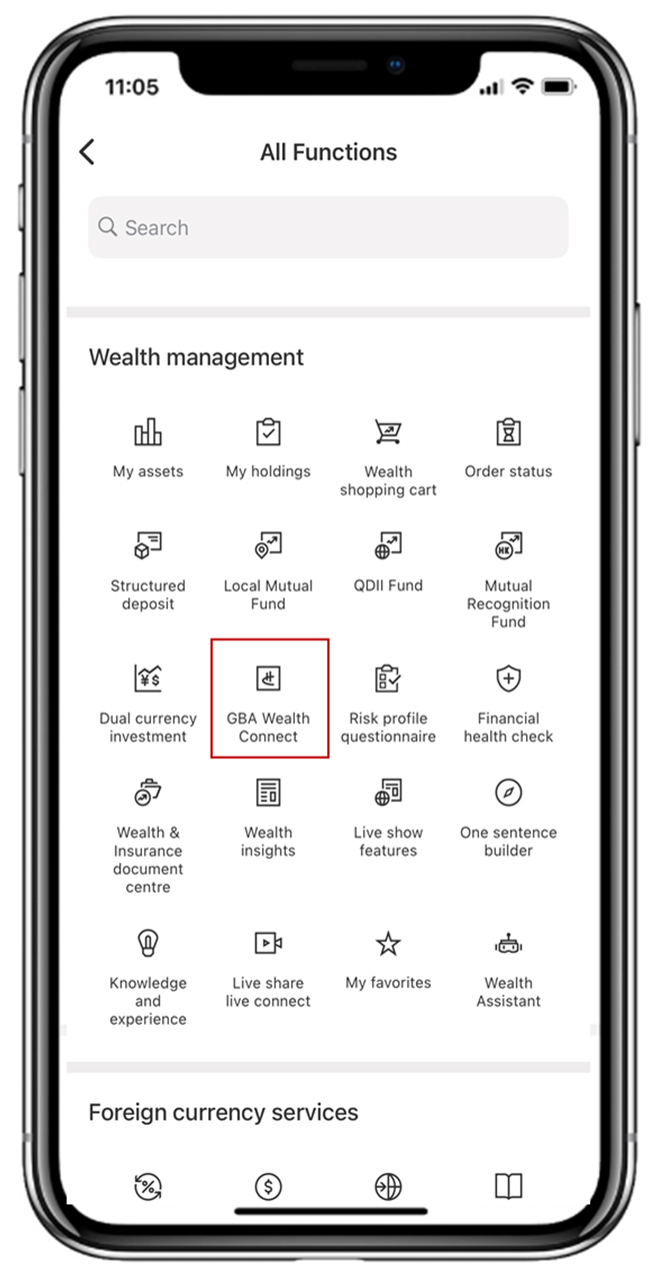

2. Log on to the HSBC China Mobile Banking app, tap 'Wealth Management' and go to 'GBA Wealth Connect'

3. Read the relevant service statement about the HSBC GBA Wealth Management Connect, then select on 'Apply for HSBC GBA Northbound Wealth Management Connect Services'

4. Fill in your HSBC HK GBA Wealth Connect services customer reference number, and the account numbers of your CNY Settlement Account Type I and HSBC GBA Wealth Connect Designated RMB Savings Account, as well as other necessary personal or account information. Read and accept the relevant terms and conditions, and submit the application

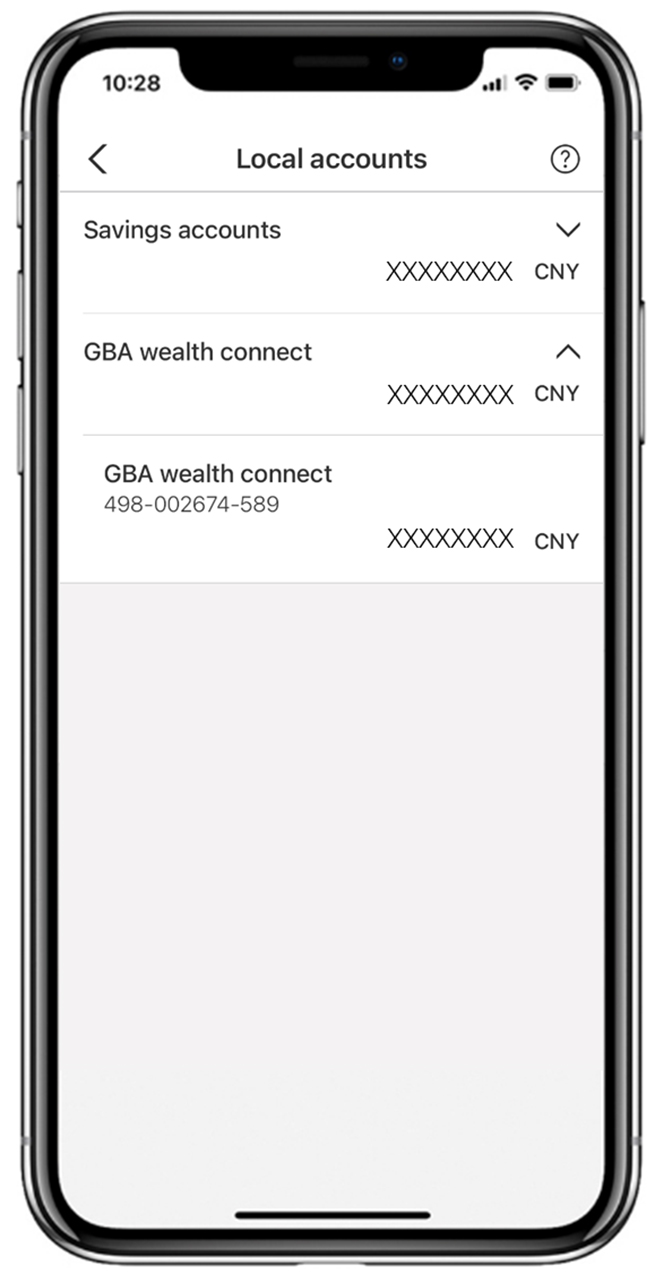

How do I check my balance and remittance for my Wealth Management Connect account via mobile banking?

You can check your balance for Wealth Management Connect and other accounts via the 'Balance overview' on the HSBC China Mobile Banking app.

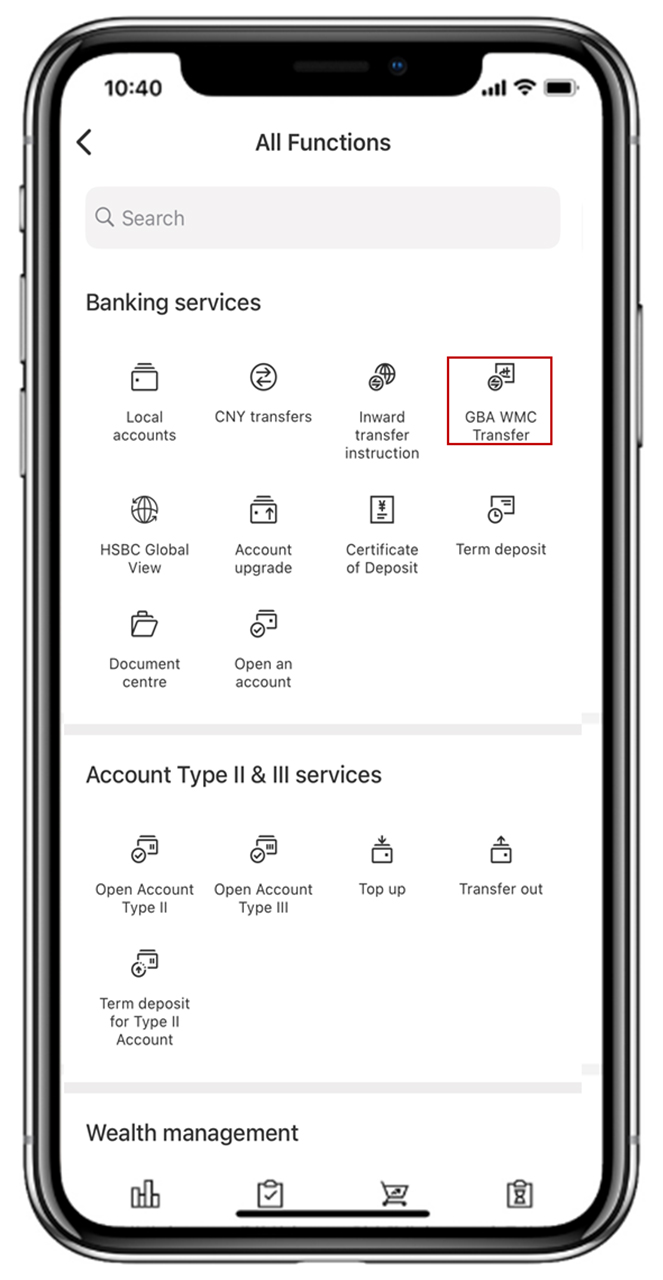

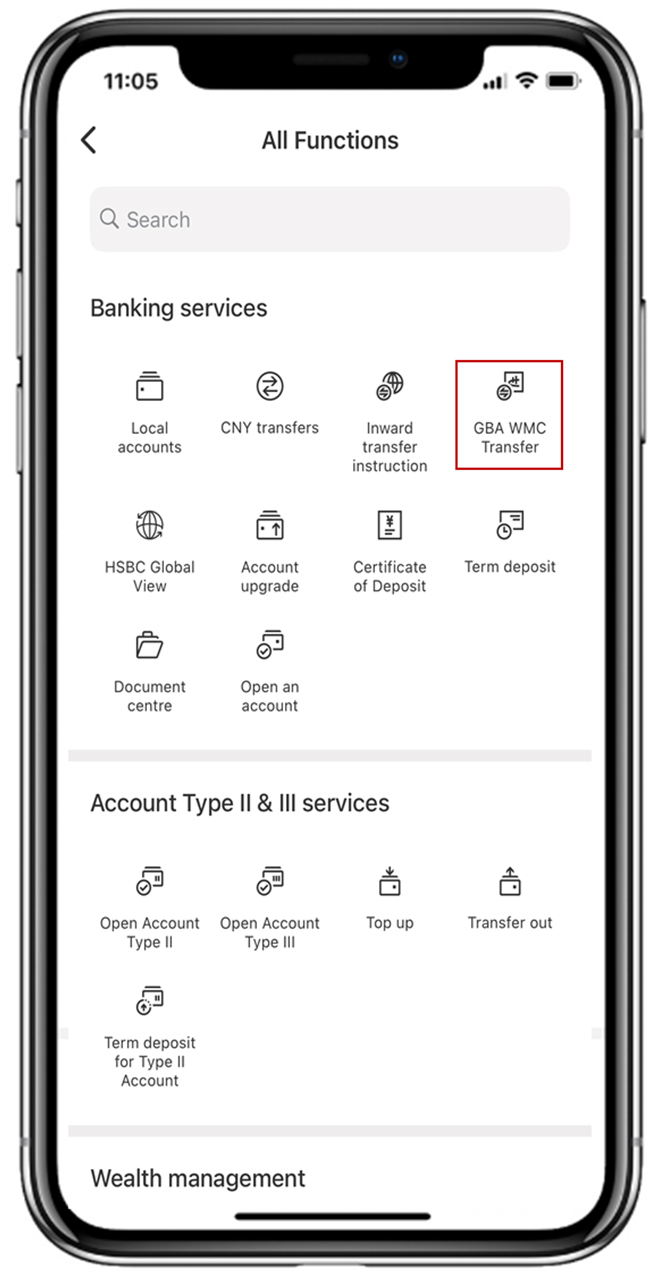

To remit money, you can do it via 'GBA Wealth Connect' on the 'Wealth' tab. Alternatively, you can also go to 'GBA WMC transfer' via the home page

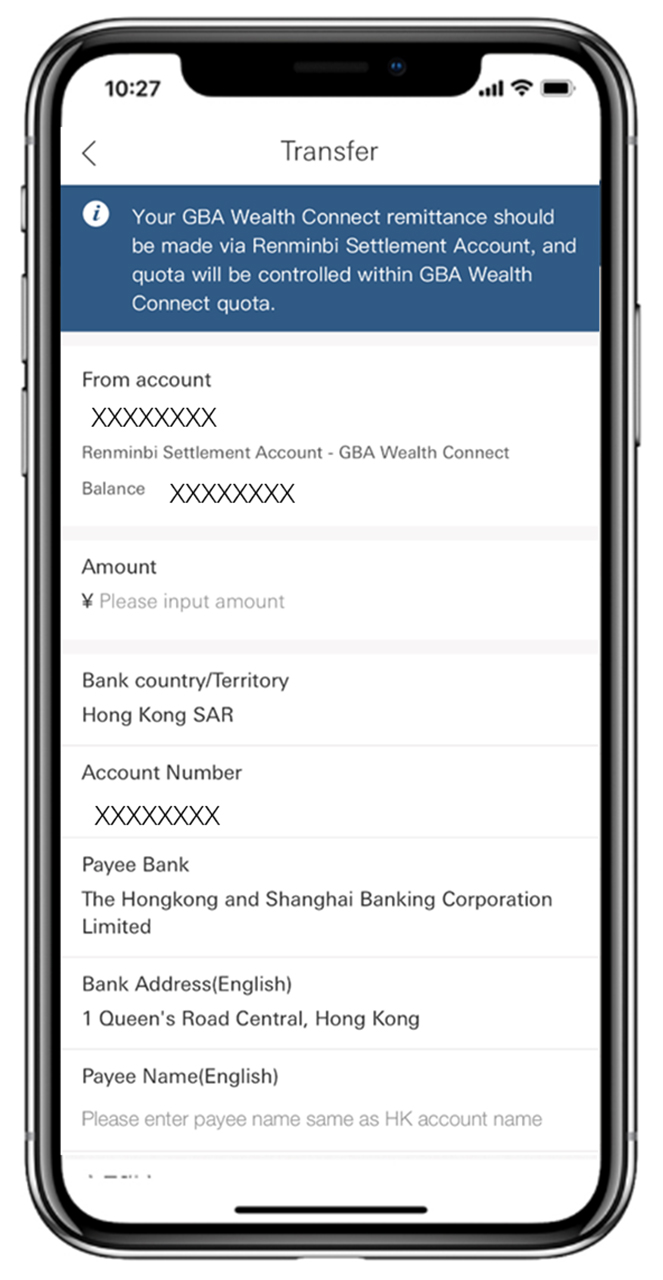

You only need to fill in your 'Amount' and 'Payee name' on the transfer page – the rest of the information will be pre-filled automatically. You also need have your Security Device on hand for the transfer.

For outward remittance transactions via HSBC Wealth Management Connect Northbound services, you can enjoy a handling fee waiver until October 18, 2023.

How do I make an investment on Wealth Management Connect online?

You can do your Risk Profiling Questionnaire as well as make subscriptions, automatic investments, redemptions and conversions on the HSBC China Mobile Banking app and HSBC Online Banking.

Step one:

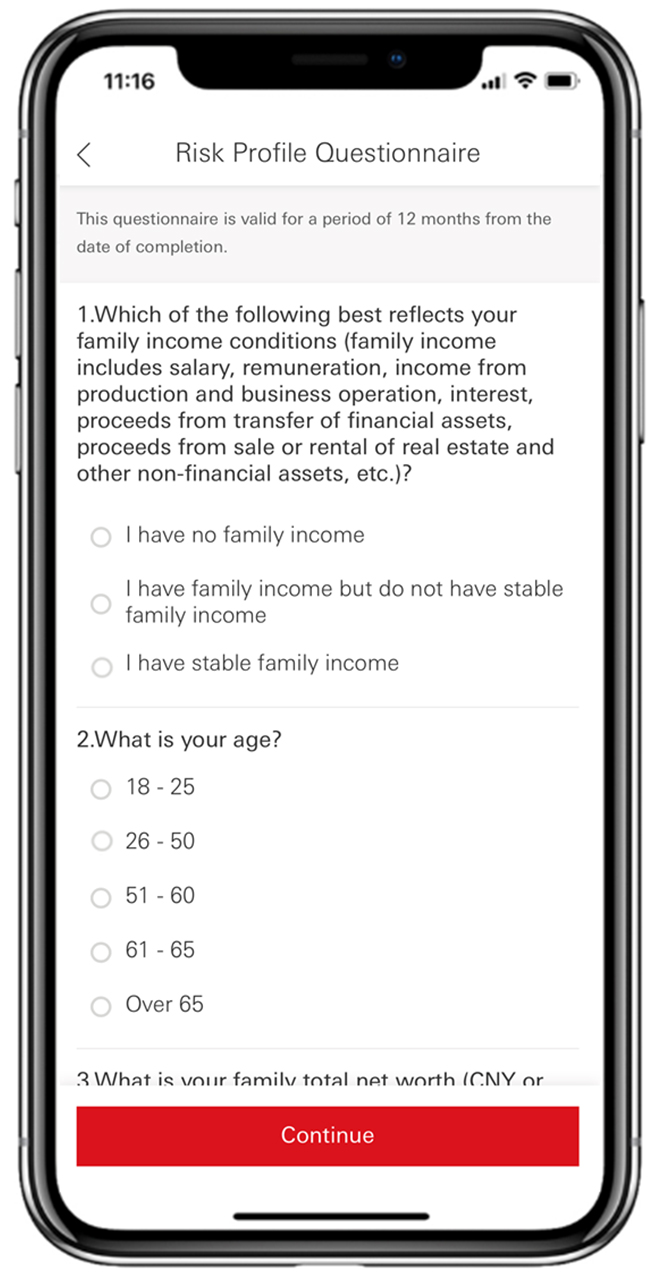

Complete your Risk Profiling Questionnaire and Questionnaire of Knowledge and Experience

HSBC GBA Northbound customers will need to complete a Risk Profiling Questionnaire via the HSBC China Mobile Banking app before making any online investment or wealth management actions.

You can access the Risk Profiling Questionnaire in the following ways:

- Go to 'Quick actions on the home page, then select 'More' > 'Wealth Management' > 'Risk Profiling Questionnaire'

- Select the 'Wealth' tab, then select 'Risk Profiling Questionnaire' via 'Quick actions'

Note: The Risk Profiling Questionnaire is only valid for 12 months. You can get a reappraisal anytime via the HSBC China Mobile Banking app.

Once you are done with the Risk Profiling Questionnaire, please complete the Questionnaire of Knowledge and Experience.

Step two:

Begin your journey with investment and financial products browsing and subscription

Let's use Local Unit Trust (distributed by HSBC China) as an example.

Once you've completed the Risk Profiling Questionnaire, you can tap on 'GBA Wealth Connect' and go to 'Local Unit Trust (distributed by HSBC China)' to learn more about the eligible investment and financial products based on your risk profile.

Step three:

How to manage my products?

After placing your subscriptions you can check any details under 'My holdings' in Wealth Management. You can then select 'Redemption / Conversion' and 'Automatic investment', for any further actions.

Wealth Assistant - get specialised wealth management support anytime with this smart assistant

Wealth Compass - we'll help create a customised product list based on your diversified investment preferences (e.g. investment target, investment market, investment currency).

You can also select 'My investment' >'Investment products'> 'Local Unit Trust (distributed by HSBC China)' via HSBC China Online Banking, and make subscriptions, automatic investments, redemptions or conversions.