What is a Security Device?

A Security Device is a small and portable electronic device about the size of half of a credit card. You'll need it to generate a one-time Security Code or Transaction Data Signing code when you log on to or make transactions via HSBC China's digital channels (Online Banking, Mobile Banking and WeChat Service Account).

To activate your Security Device, you'll need to set up a 6-digit PIN first, which will be used to start the device and protect it from potential security threats.

Get started with your Security Device

- How do I get a Security Device?

- How do I activate my new Security Device?

- Using your Security Device

- Forgotten your Security Device PIN?

- We've launched Digital Authentication to bring you a safer and faster way to bank, online and on mobile, without the need to carry a physical security device. Activate Digital Authentication on the HSBC China Mobile Banking app now to log on or make transactions, the new way.

- If you still prefer to apply for a physical security device, call our customer service hotline on 95366 to get one.

If you already have a security device, you can log on to your online banking, follow the steps on the page to complete the activation and enjoy a secure and convenient banking experience.

If there's no reminder when log on, you can call our customer service hotline on 95366 or follow the steps below to complete activation:

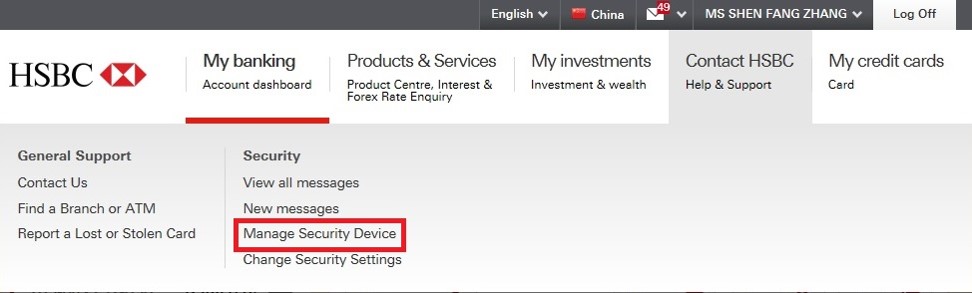

- Log on to your online banking, select 'Manage Devices' under 'Contact HSBC' in the top navigation bar or 'My Profile' at the bottom of the page

- Tap ’Manage your devices' and then 'Activate Security device'. Follow the instructions to activate and bind your device.

Please refer to the following information on how to use your Security Device.

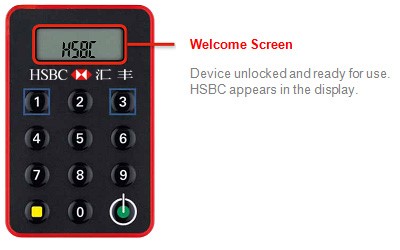

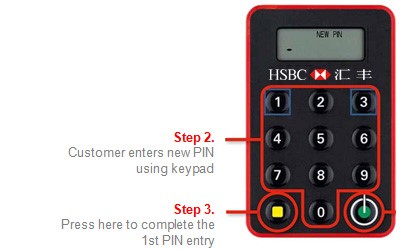

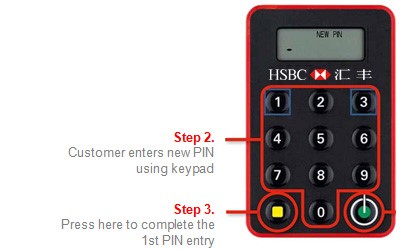

1. Setting up a PIN for your new Security Device

Press and hold the green button until you see a 'New PIN' message on the device, then enter a 6-digit PIN. Press the yellow button to complete your first PIN entry, then re-enter your PIN. Once successful, the screen will display 'HSBC'.

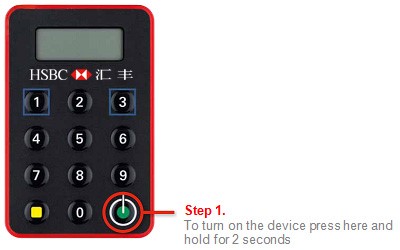

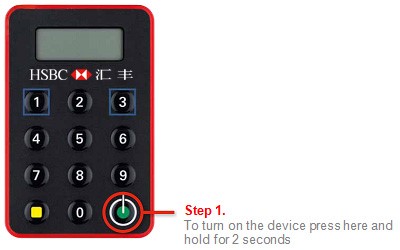

2. Turning on your Security Device

Press and hold the green button for 2 seconds, then enter your PIN to turn on the device.

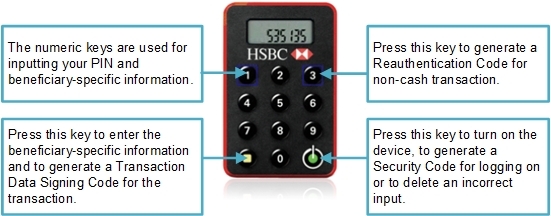

3. Generating a Transaction Data Signing code

You may need to enter a Transaction Data Signing code as a last step when you make transfers in renminbi or foreign currencies on HSBC China's digital channels (Online Banking, Mobile Banking and WeChat Service Account).

To do so, press and hold down the green button to turn on the device. Then press the yellow button. Enter the last 8 numbers of the receiving account and press the yellow button again. Your Security Device will display a 6-digit Transaction Data Signing code, which you'll need to enter onto a digital banking platform to complete your transaction.

(Your Security Device is not needed for domestic transfers less than RMB50,000.)

4. Clearing wrong numbers on the device

If you've entered wrong account number when making transfers or remittances, you can press the bottom right green button to clear one number. To clear the entire entry, press and hold the same green button.

5. Changing your personal information

Scenario 1: When you need to enter a 6-digit re-authentication code to modify and increase the transfer limit (re-authentication code is not required for modifying and reducing the transfer limit), you can directly generate it by pressing button 3 after turning on the device.

Scenario 2: When you need to enter a 6-digit security PIN to change your personal information, you can directly press the green button to generate it after turning on the device.

Reminder: If the transfer limit you need to increase is higher than the maximum transfer limit indicated by the system, you need to go to a branch in person.

6. Changing your PIN for the device

If you need to change your PIN, first press and hold the green button and enter the original PIN. After you see the word 'HSBC', press the '8' button for 2 seconds until the words 'NEW PIN' appear. You can then enter a new 6-digit PIN to complete the process.

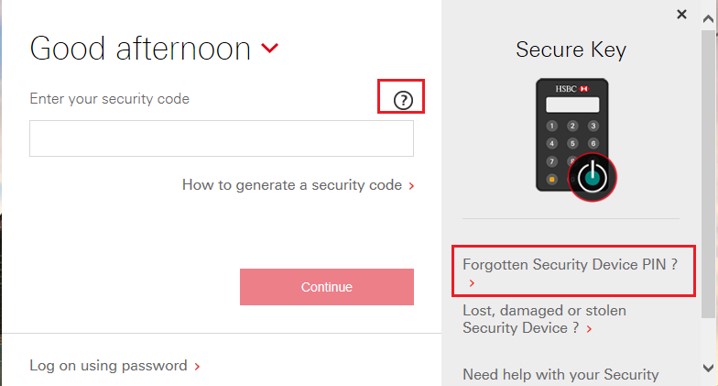

You can log on to online banking to reset your password. Go to the online banking page, enter your username as usual. Select 'Continue' and then choose 'Log on with security code'. Then select the question mark icon. A pop up will appear with the option 'Forgotten Security Device PIN?'. Simply select that option and follow the instructions to complete your password reset.

You can also call our customer service hotline on 95366 to reset your password.

How do I get a Security Device?

- We've launched Digital Authentication to bring you a safer and faster way to bank, online and on mobile, without the need to carry a physical security device. Activate Digital Authentication on the HSBC China Mobile Banking app now to log on or make transactions, the new way.

- If you still prefer to apply for a physical security device, call our customer service hotline on 95366 to get one.

How do I activate my new Security Device?

If you already have a security device, you can log on to your online banking, follow the steps on the page to complete the activation and enjoy a secure and convenient banking experience.

If there's no reminder when log on, you can call our customer service hotline on 95366 or follow the steps below to complete activation:

- Log on to your online banking, select 'Manage Devices' under 'Contact HSBC' in the top navigation bar or 'My Profile' at the bottom of the page

- Tap ’Manage your devices' and then 'Activate Security device'. Follow the instructions to activate and bind your device.

Using your Security Device

Please refer to the following information on how to use your Security Device.

1. Setting up a PIN for your new Security Device

Press and hold the green button until you see a 'New PIN' message on the device, then enter a 6-digit PIN. Press the yellow button to complete your first PIN entry, then re-enter your PIN. Once successful, the screen will display 'HSBC'.

2. Turning on your Security Device

Press and hold the green button for 2 seconds, then enter your PIN to turn on the device.

3. Generating a Transaction Data Signing code

You may need to enter a Transaction Data Signing code as a last step when you make transfers in renminbi or foreign currencies on HSBC China's digital channels (Online Banking, Mobile Banking and WeChat Service Account).

To do so, press and hold down the green button to turn on the device. Then press the yellow button. Enter the last 8 numbers of the receiving account and press the yellow button again. Your Security Device will display a 6-digit Transaction Data Signing code, which you'll need to enter onto a digital banking platform to complete your transaction.

(Your Security Device is not needed for domestic transfers less than RMB50,000.)

4. Clearing wrong numbers on the device

If you've entered wrong account number when making transfers or remittances, you can press the bottom right green button to clear one number. To clear the entire entry, press and hold the same green button.

5. Changing your personal information

Scenario 1: When you need to enter a 6-digit re-authentication code to modify and increase the transfer limit (re-authentication code is not required for modifying and reducing the transfer limit), you can directly generate it by pressing button 3 after turning on the device.

Scenario 2: When you need to enter a 6-digit security PIN to change your personal information, you can directly press the green button to generate it after turning on the device.

Reminder: If the transfer limit you need to increase is higher than the maximum transfer limit indicated by the system, you need to go to a branch in person.

6. Changing your PIN for the device

If you need to change your PIN, first press and hold the green button and enter the original PIN. After you see the word 'HSBC', press the '8' button for 2 seconds until the words 'NEW PIN' appear. You can then enter a new 6-digit PIN to complete the process.

Forgotten your Security Device PIN?

You can log on to online banking to reset your password. Go to the online banking page, enter your username as usual. Select 'Continue' and then choose 'Log on with security code'. Then select the question mark icon. A pop up will appear with the option 'Forgotten Security Device PIN?'. Simply select that option and follow the instructions to complete your password reset.

You can also call our customer service hotline on 95366 to reset your password.

Help centre

Your Security Device is lost, stolen or damaged

You can call our 24/7 customer service hotline on 95366.

In general, if the mailing address you've registered with us is in mainland China, your Security Device will be delivered to you within 3 working days via registered mail.

If you've registered an address outside of mainland China, we'll send it to you via airmail, and delivery may take more than 3 working days. Please note that there might be a delay in delivering Security Devices to addresses outside of mainland China, due to recent international express security inspection process. We appreciate your understanding and patience.

If the address at which you wish to receive the Security Device is not your current correspondence or residential address, please send your preferred address to us through the 'Send us a message' function in online banking.

What should I do when the battery of my Security Device is about to run out?

The battery in the Security Device cannot be replaced. Please contact us once your Security Device warns you that the battery is running low. Simply visit any of our branches or directly call our customer service hotline on 95366 to apply for a new device.

We'll send the replacement Security Device to you by mail. Before you receive and activate your new Security Device, you can continue to use the one you currently use.

What should I do if my Security Device is locked?

| Security Device lock Scenarios | Status | Lock period | Solution |

|---|---|---|---|

| Scenario 1: You entered the wrong Security Device PIN 3 times in a row after turning on the device. | A 7-digit code will be displayed on screen.It will still show up after the device is automatically shut down and restarted. | Forever | You can call our customer service hotline on 95366 for help. |

| Scenario 2: You entered the wrong Transaction Data Signing code 3 times in a row. | Transfers needing a Transaction Data Signing code will not be allowed. |

15 minutes | Option 1: The Security Device will automatically unlock after 15 minutes. Option 2: If you prefer not to wait, you can call our customer service hotline on 95366 to help you unlock your device. |

| Scenario 3: You entered the wrong 6-digit number 3 times in a row when using it to change your personal information (such as increasing transaction limit or changing personal details) on our digital banking platforms. | A message from online banking will show up to inform you that the Security Device has been locked. | 5 minutes | Please retry in 5 minutes. |

| Security Device lock Scenarios | Scenario 1: You entered the wrong Security Device PIN 3 times in a row after turning on the device. |

|---|---|

| Status | A 7-digit code will be displayed on screen.It will still show up after the device is automatically shut down and restarted. |

| Lock period | Forever |

| Solution |

You can call our customer service hotline on 95366 for help. |

| Security Device lock Scenarios | Scenario 2: You entered the wrong Transaction Data Signing code 3 times in a row. |

| Status |

Transfers needing a Transaction Data Signing code will not be allowed. |

| Lock period | 15 minutes |

| Solution |

Option 1: The Security Device will automatically unlock after 15 minutes. Option 2: If you prefer not to wait, you can call our customer service hotline on 95366 to help you unlock your device. |

| Security Device lock Scenarios | Scenario 3: You entered the wrong 6-digit number 3 times in a row when using it to change your personal information (such as increasing transaction limit or changing personal details) on our digital banking platforms. |

| Status | A message from online banking will show up to inform you that the Security Device has been locked. |

| Lock period | 5 minutes |

| Solution | Please retry in 5 minutes. |

How to apply the Security Device after self-registration? And how long it takes?

We've launched Digital Authentication to bring you a safer and faster way to bank, online and on mobile, without the need to carry a physical security device. Activate Digital Authentication on the HSBC China Mobile Banking app now to log on or make transactions, the new way.

If you still prefer to apply for a physical security device, call our customer service hotline on 95366, and we will arrange the delivery for you. In general, if the mailing address you've registered with us is in mainland China, your security device will be sent out to you in 3 working days. If you've registered an address outside of mainland China, it may take longer.

Please note that you should bring valid identification documents and visit your local branch in person for online or mobile payment service.

What is a Security Device?

A Security Device is a small, portable electronic device, which generates random Security Code and Transaction Data Signing Code for one-time use, required to log on and transact on HSBC China digital channels (Online Banking, Mobile Banking and WeChat Service Account). It is one-time use, anti-shoulder-surfing, electric wave free, card reader free, anti-spyware and anti-virus.

Security Device

Enhanced Transaction Security

The new Security Device provides HSBC China digital channels users with extra security to protect against fraudulent transactions. This requires you to:

• Key in beneficiary-related information on the device for every transaction

• Generate an unique Transaction Data Signing Code on the device to authorise each transaction of transfer/remittance

PIN-Protected Security Device

The HSBC China Security Device is unique as it is PIN-protected. You will have to set a Security Device PIN during activation and this PIN will be required to unlock the device before each use.

Why is HSBC China issuing the Security Device to HSBC Online Banking customers?

HSBC China is committed to protecting the security of our HSBC Online Banking customers. HSBC has made the decision to issue a Security Device to all HSBC Online Banking customers to offer better protection from a variety of potentially damaging attacks.

| Identity theft |

Trojans (Keylogging/Screen Capturing) |

Phishing |

Man in the middle |

Shoulder surfing |

|---|---|---|---|---|

| Where a fraudster obtains personal details and uses these details to complete fraudulent activities such as applying for loans, credit cards, ordering chequebooks, etc. |

Where a victim discloses their confidential credentials to a fraudster through a Trojan virus unknowingly downloaded on their PC. |

Where a fraudster "phishes" for confidential information from a customer by pretending to be from a legitimate source such as a bank or a financial institution. These details are later re-used to carry out fraudulent transactions. |

Where a fraudster intrudes into an existing connection to intercept the exchanged data and injects false information. |

Where a fraudster observes a victim entering their confidential details, and then re-uses these details to carry out fraudulent transactions. |

| Identity theft |

Where a fraudster obtains personal details and uses these details to complete fraudulent activities such as applying for loans, credit cards, ordering chequebooks, etc. |

|---|---|

| Trojans (Keylogging/Screen Capturing) |

Where a victim discloses their confidential credentials to a fraudster through a Trojan virus unknowingly downloaded on their PC. |

| Phishing |

Where a fraudster "phishes" for confidential information from a customer by pretending to be from a legitimate source such as a bank or a financial institution. These details are later re-used to carry out fraudulent transactions. |

| Man in the middle |

Where a fraudster intrudes into an existing connection to intercept the exchanged data and injects false information. |

| Shoulder surfing |

Where a fraudster observes a victim entering their confidential details, and then re-uses these details to carry out fraudulent transactions. |

What is the difference in functionality between the new and the existing Security Device?

The new Security Device gives HSBC China digital channels (Online Banking, Mobile Banking and WeChat Service Account) extra security and provides better protection for "Transfers to third party beneficiaries" by requiring customers to input beneficiary-specific information (e.g. account number) to generate a Transaction Data Signing Code .

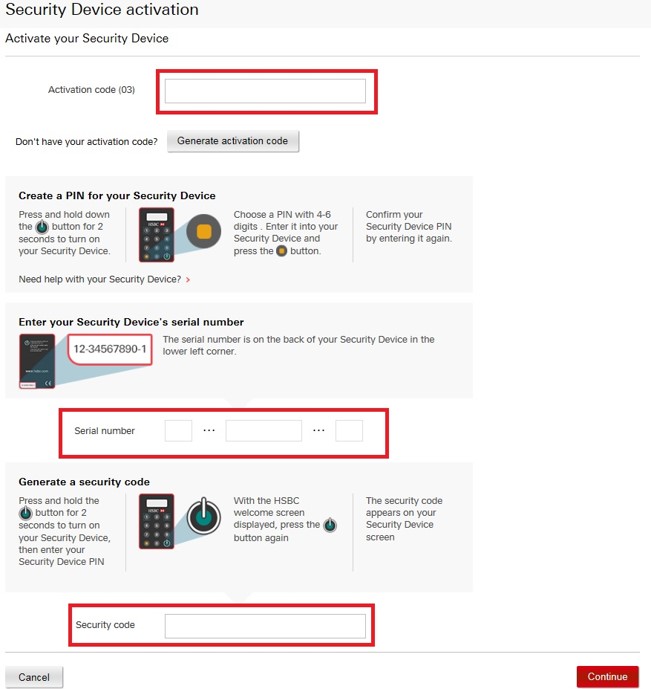

How do I activate my new Security Device?

Please follow the steps below to activate your new Security Device:

How do I use my Security Device to log on and when do I need to use the numeric keys?

What is a security code?

The Security Code is a one-time password used to access your Online Banking Service. You receive this password by pressing the grey button on the Security Device. You will need to use this Security Code along with your username and password to access your HSBC Online Banking accounts. This security Code is needed when you log onto your Online Banking, conduct transfer/remittance, update your Online and request a new password.

Why do I have to set up a PIN for the new Security Device?

The HSBC Security Device is unique as it is PIN-protected. For added security, you will have to set a PIN during activation and this PIN will be required to unlock your device before use.

How many digits can I choose for the PIN?

You can only choose a 6-digit PIN for the new device.

How do I set up the PIN for my new Security Device? How do I change my PIN for Security Device?

1) Set up

2) Change

What happens if my PIN setup is unsuccessful?

A message 'FAIL PIN' will be shown on the device, reflecting that your confirmation PIN did not match the first PIN entered. You will need to restart the PIN setup process by pressing the green button.

Why do I see a message 'NEW PIN not SAFE' on the device?

This means that the new PIN that you have entered is not safe and could be guessed easily, ie repeating or sequential numbers (ie 111111, 123456, 543210). Please restart the PIN setup process and choose another 6-digit PIN.

How can I activate my new Security Device? What if I haven't received the mobile phone activation code?

1) Log on the Online Bank and select 'Contact HSBC' —'Manage Security Device'.

2) If you received security token already, please select 'Continue'.

3) Enter your activation code and Security Device's service number, then follow the steps to setup the password for your Security Device.

During the activation, you need input your activation code via SMS. The mobile phone number should begin with "+ 86", or you'll miss the SMS. If you mobile phone number is incorrect, please visit any HSBC branch to register a valid mobile number.

What should I do if I forget my PIN for the device?

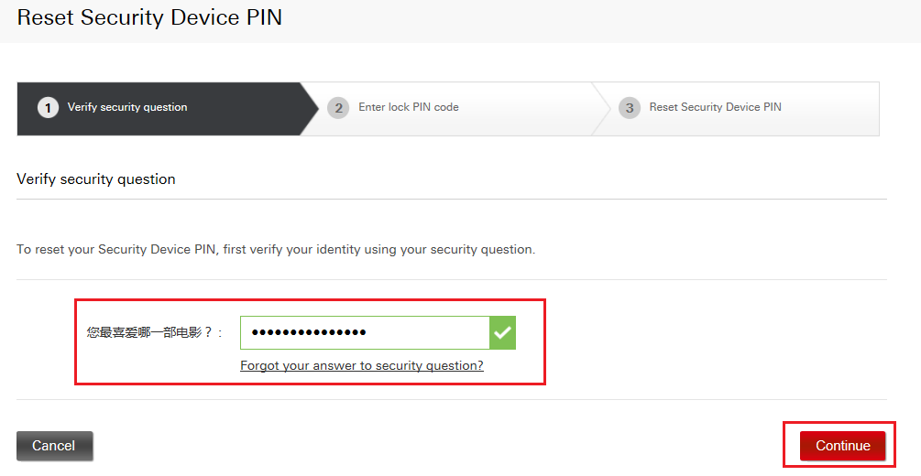

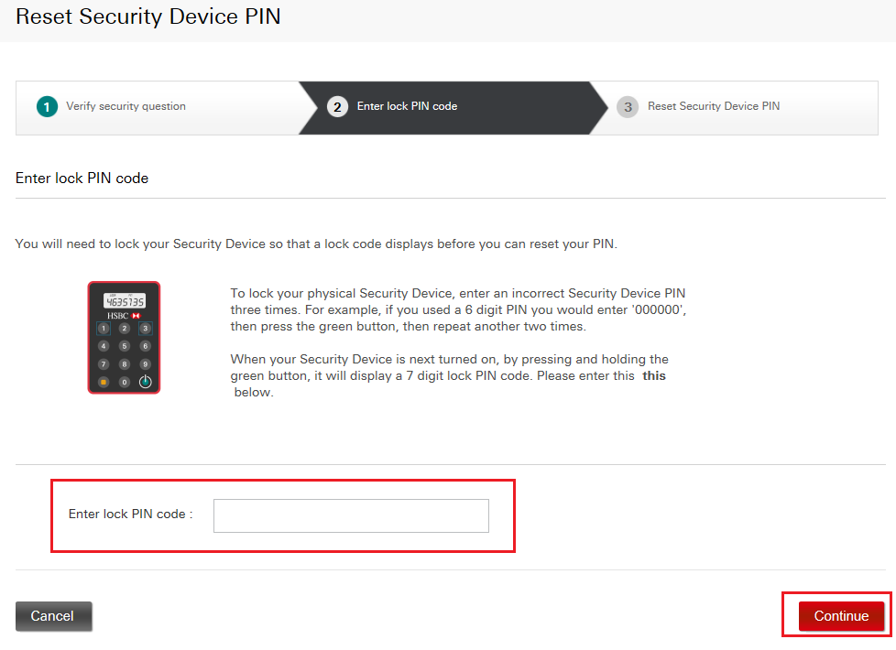

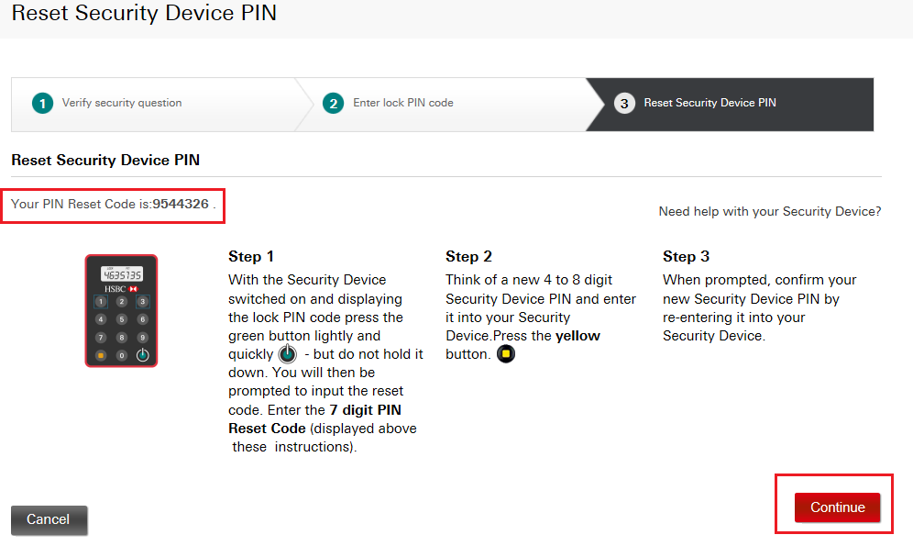

1) Enter the username and click the '?' button and 'Forgotten Security Device PIN?' button as below.

2) Verify security question.

3) Enter Lock PIN code.

4) Reset Security Device PIN.

What should I do if my Security Device is lost or stolen?

You should inform us to de-activate your lost or stolen Security Device immediately. Please contact our branches or call our customer service hotline on 400-820-8878 (Please dial the country code of mainland China +86 if you are calling from overseas, Hong Kong SAR, Macau SAR, or Taiwan).

How does inputting beneficiary-specific information into my Security Device increase the security level of transactions via Online Banking?

The new Security Device requires you to input beneficiary-specific information (ie account number) into your Security Device to generate a Transaction Data Signing Code to authorise your transaction. With this additional transaction verification function it further prevents fraudulent attacks as the transaction will only be made to the account specified by you. This layer of protection provides an increased level of security for your online banking transactions.

When do I have to input beneficiary-specific information into my Security Device?

You need to input such information into your Security Device when you are making the "Transfers to third party beneficiaries" transaction.

How do I know what beneficiary-specific information I need to input into my Security Device?

Please follow the on-screen instructions on the security code input page on HSBC Online Banking to input the correct information into your Security Device and generate the required security code.

Please note that this kind of transaction confirmation can only be conducted with 4-digits (or more) beneficiary accounts. You have to visit a local branch to conduct such transactions if the beneficiary accounts number is less than 4-digits.

| Scenario | How to input your instructions | Example | Input |

|---|---|---|---|

| Beneficiary account number with 8 or more digits | Use the last 8 digits of your beneficiary account number | 123-456-789 55500066777 |

23456789 00066777 |

| Beneficiary account number with 4-7 digits | Add zeros in front of your beneficiary account number to form a total of 8 digits | 12345 AB234-5 |

00012345 00002345 |

| Beneficiary account number comprising letters and 8 or more digits | Omitting non-numeric characters and spaces, enter the last 8 digits of your beneficiary account number into your Security Device | 123A4567BC89D AB11-200CD777 333Y 44W 5555 |

23456789 11200777 33445555 |

| Beneficiary account number comprising letters and 4-7 digits | Omitting non-numeric characters and spaces, add zeros in front of these digits to form a total of 8 digits | 123A4567BCD AB11-200C 33Y 44W |

01234567 00011200 00003344 |

| Scenario | Beneficiary account number with 8 or more digits |

|---|---|

| How to input your instructions | Use the last 8 digits of your beneficiary account number |

| Example |

123-456-789 55500066777 |

| Input |

23456789 00066777 |

| Scenario | Beneficiary account number with 4-7 digits |

| How to input your instructions | Add zeros in front of your beneficiary account number to form a total of 8 digits |

| Example |

12345 AB234-5 |

| Input |

00012345 00002345 |

| Scenario | Beneficiary account number comprising letters and 8 or more digits |

| How to input your instructions | Omitting non-numeric characters and spaces, enter the last 8 digits of your beneficiary account number into your Security Device |

| Example |

123A4567BC89D AB11-200CD777 333Y 44W 5555 |

| Input |

23456789 11200777 33445555 |

| Scenario | Beneficiary account number comprising letters and 4-7 digits |

| How to input your instructions | Omitting non-numeric characters and spaces, add zeros in front of these digits to form a total of 8 digits |

| Example |

123A4567BCD AB11-200C 33Y 44W |

| Input |

01234567 00011200 00003344 |

What do I do if I have incorrectly input the security code too many times and my account transaction gets locked?

When the security code is entered incorrectly five times in a row, your account will be locked to protect against unauthorised use. In case of emergency, you can call our customer service hotline to unlock the account.

What should I do if I have entered a wrong number into my Security Device during the authorisation process?

If you have entered a wrong number into your Security Device, press the green button in the bottom right corner to backspace and delete your last entry. To clear your entire entry, press and hold the green button in the bottom right corner.

What should I do if the security code I have input on HSBC Online Banking is not accepted?

- Please ensure the security code you have input matches the security code displayed on your Security Device.

- If the security code matches the security code on your device, the beneficiary-specific information entered previously may be incorrect.

- Please follow the on-screen instructions and repeat the process to generate a security code.

If the security code is still not accepted, Please call our customer service hotline on 400-820-8878 (Please dial the country code of mainland China +86 if you are calling from overseas, Hong Kong SAR, Macau SAR, or Taiwan).

What is a serial number?

The serial number is a unique 10-digit number used to identify your individual Security Device. It is located at the back of your Security Device in the format of XX-XXXXXXX-X where X represents a number (ie 12-3456789-0). This number also helps with identification in the case of multiple Security Devices in a household or company and should not be removed.

Are there any risks associated with the serial number on the Security Device being visible?

The serial number is only used to identify which Security Device is associated with a specific customer and is only required for the activation process. There is no risk associated with the serial number being visible.

Why is there a square border surrounding the numeric keys '1' and '3' on the new Security Device? Does it indicate any special meaning or function?

For HSBC China, there is no particular meaning or function associated with this key.

Why do I see a 'FAIL 1', 'FAIL 2' or 'FAIL 3' message on the Security Device?

This is because the PIN entered is incorrect. Please press the green button to re-enter your PIN. You will have a total of three attempts to enter a correct PIN before the device is locked.

Please call our contact centre hotline on 400-820-8878 (Please dial the country code of mainland China +86 if you are calling from overseas, Hong Kong SAR, Macau SAR, or Taiwan), our customer service representative will assist you to reset the PIN after your Phone Banking PIN is verified.

How long will the battery of the Security Device last?

The Security Device is battery-powered with a lifespan between three to five years, depending on the frequency of the usage. You will be prompted with a "BATT#" message when the battery of your Security Device is running low.

| Indicator | What It Means |

|---|---|

| BATT5 | 5 weeks estimated battery life remaining |

| BATT4 | 4 weeks estimated battery life remaining |

| BATT3 | 3 weeks estimated battery life remaining |

| BATT2 | 2 weeks estimated battery life remaining |

| BATT1 | 1 weeks estimated battery life remaining |

| BATT0 | Battery life is exhausted |

| Indicator | BATT5 |

|---|---|

| What It Means | 5 weeks estimated battery life remaining |

| Indicator | BATT4 |

| What It Means | 4 weeks estimated battery life remaining |

| Indicator | BATT3 |

| What It Means | 3 weeks estimated battery life remaining |

| Indicator | BATT2 |

| What It Means | 2 weeks estimated battery life remaining |

| Indicator | BATT1 |

| What It Means | 1 weeks estimated battery life remaining |

| Indicator | BATT0 |

| What It Means | Battery life is exhausted |

Do I have to replace the battery in my Security Device when it runs out?

No, the battery in the Security Device can't be removed. When your Security Device warns you that the battery is running low, you will need to contact us to get a replacement device.

How do I replace my Security Device if the battery is running low?

You should visit a local branch or call our customer service hotline. The replacement Security Device will be sent to your mailing address previously registered with the Bank.

You can continue to use your existing Security Device until you have received and activated your replacement.

What should I do if my Security Device is broken?

You should visit a local branch or call our customer service hotline. The replacement Security Device will be sent to your mailing address previously registered with the Bank.