16 Dec 2024

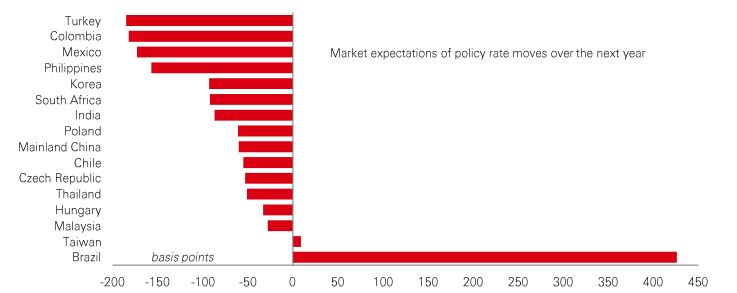

The stars aligned for a broad range of EM asset classes to perform well in 2024, propelled by the prospect of Fed rate cuts, Chinese policy stimulus, and a backdrop of big valuation discounts. While this could continue in 2025, the outlook for EMs has recently become less certain, meaning investors need to be selective.

In terms of risks, active fiscal policy, global trade uncertainty, and geopolitical tensions can stoke market volatility, and mean concerns over inflation are likely to persist for a bit longer in 2025. This unsettled backdrop is already creating policy divergence across major EM economies.

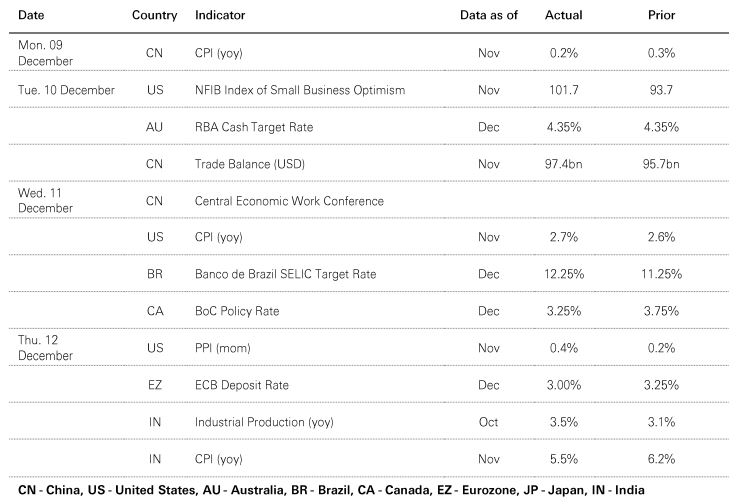

China, for instance, has maintained a gradual approach to policy easing this year, with authorities last week formally shifting the monetary policy stance from “prudent” to “moderately loose”, helping to buoy stocks. This move came as policymakers debated the economic agenda for 2025 at the annual Central Economic Work Conference, paving the way for further easing. By contrast, India faces a more complicated trade-off between growth and inflation amid a cyclical slowdown and volatile inflation driven by food prices. While growth is expected to recover, and inflation normalise, policymakers currently remain cautious, with a “neutral” policy stance. And at the other end of the spectrum, Brazil’s central bank was forced to make a higher-than-expected 1% rate hike last week in its efforts to stabilise inflation.

Put together, we think this divergent policy backdrop – with regions performing differently and facing different sets of challenges – means investors need to do their homework when deciding EM allocations.

An interesting divergence in fiscal policy has emerged between a number of frontier and mainstream emerging markets – with previous fiscal “saints” and “sinners” switching roles. Some formerly fragile frontier economies have been embracing reforms, and boosting their sustainability metrics, just as several EMs have seen a deterioration.

Frontier markets like Argentina, Ecuador, Ethiopia, Kenya, Nigeria, Pakistan, Sri Lanka, and Turkey have adopted reforms (often supported by IMF programs) aimed at mitigating vulnerabilities. Policies have included ending FX market distortions, reining in public debt by targeting primary surpluses, and accumulating foreign exchange reserves.

Meanwhile, some mainstream EMs usually associated with stronger macroeconomic fundamentals and better institutional credibility have been pursuing looser fiscal policies – leading to a widening of budget deficits. Prominent examples include Brazil, Hungary, Indonesia, Mexico, Poland, and Thailand.

In many cases, these looser policies have been deployed to stimulate domestic growth, and active fiscal policy will be a key feature of the global macro environment in 2025. For investors, it’s a further reminder that selectivity will be important in finding opportunities in EM and FM markets.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Diversification does not ensure a profit or protect against loss. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 13 December 2024. Chinese equity views herein are from HSBC GPB and Wealth Global Investment Committee

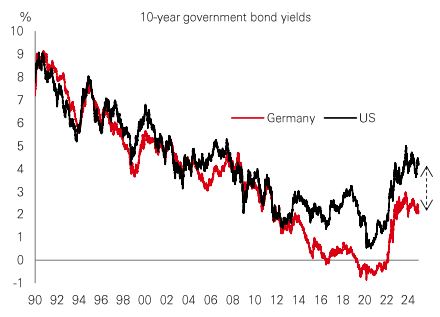

Following the recent political drama in Europe, the ECB did its best not to add to the volatility and delivered the expected 0.25% rate cut, shunning any pressure to follow the Bank of Canada and Swiss National Bank which delivered 0.50% moves.

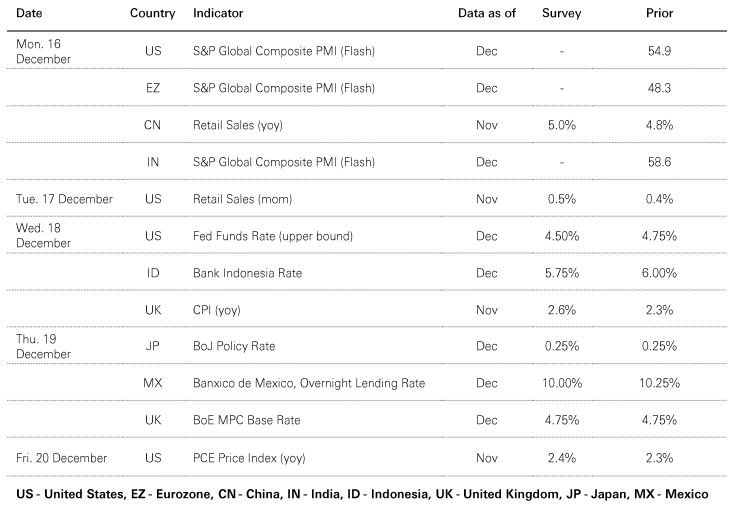

With Chair Powell having said recently that the Fed could afford to be “a little more cautious” in delivering rate cuts, it was unlikely that the ECB would throw caution to the wind. While recent eurozone survey data have shown renewed signs of weakness, they have not been the best guide to growth in the past few years. And although the latest CPI data suggest previously sticky service sector inflation may now be softening, more progress on this front would have been needed to prompt an aggressive move by the ECB.

However, further easing is coming. With an uncertain political landscape and the potential for the US to impose trade tariffs, downside risks to growth mean the cutting cycle could either extend into H2 or happen faster. This supports the outlook for Bunds, even if a narrowing of the yield gap versus Treasuries would likely be required for a big rally to take hold.

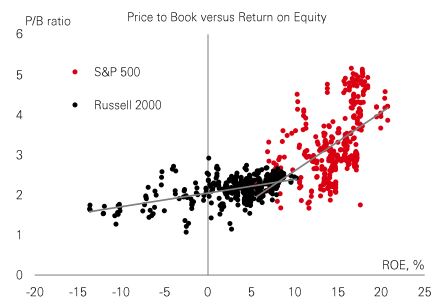

Small-cap stocks are traditionally popular with investors looking for rapid earnings growth and superior returns. But at the index level, US small-caps have underperformed large-caps since 2008. Today, valuation divergence between them has reached historic extremes, with average price-to-book valuations of 5.0 and 2.0 respectively.

One factor driving this is company profitability. Research shows that, at more than 15%, the spread of Return on Equity (a measure of profitability) has opened up between them in recent years. Large caps have become more profitable, which is reflected in higher valuations, whereas small-caps have deteriorated.

For investors, it’s a reminder that small-cap investing demands nuance. Looking globally to regions like Europe and China, smaller-cap stocks are more closely tied to macro-economic cycles and activity. That can make them volatile, but it also offers potentially attractive exposure to economic recoveries.

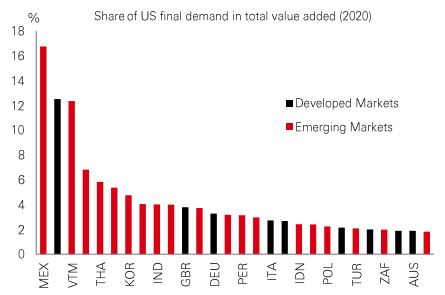

Trade tariffs are back on the table post-US election – but depending on the details, not all economies will feel the impact equally. In emerging markets, major exporters to the US like Mexico and Vietnam could face some of the greatest risks. But across Asia, the picture is mixed. Technology and electronics centres like South Korea, Taiwan, Malaysia, and Thailand don’t have the same US exposure as Vietnam, but they are more reliant on US trade than India and Indonesia.

Combined with reasonable valuations in much of Asia, the fact that tariffs are not a given and, even if they are delivered, could take some time.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Source: JP Morgan, HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 7.30am UK time 13 December 2024.

Source: HSBC Asset Management. Data as at 7.30am UK time 13 December 2024. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk markets lacked clear direction, with the US DXY dollar index strengthening on continued “US exceptionalism”. US Treasuries lagged eurozone government bonds on rising inflation jitters. The ECB lowered rates by 0.25%, dropping their reference to “sufficiently restrictive” monetary policy. US equities retreated from their highs, with the tech-driven Nasdaq outperforming. The Euro Stoxx 50 edged down, as the Nikkei climbed on a weaker Japanese yen, with technology stocks leading. China’s Shanghai Composite reversed early gains last week as investors digested the policy signals from the key meetings, while Hong Kong’s Hang Seng closed higher. South Korea’s Kospi index rebounded, whereas India’s Sensex declined. In Latin America, the Bovespa ended almost flat as Brazil’s central bank hiked rates by 1%. In commodities, oil prices and gold rallied, but copper edged lower.

This document or video is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document or video is distributed and/or made available, HSBC Bank (China) Company Limited, HSBC Bank (Singapore) Limited, HSBC Bank Middle East Limited (UAE), HSBC UK Bank Plc, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (20080100642 1 (807705-X)), HSBC Bank (Taiwan) Limited, HSBC Bank plc, Jersey Branch, HSBC Bank plc, Guernsey Branch, HSBC Bank plc in the Isle of Man, HSBC Continental Europe, Greece, The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank (Vietnam) Limited, PT Bank HSBC Indonesia (HBID), HSBC Bank (Uruguay) S.A. (HSBC Uruguay is authorised and oversought by Banco Central del Uruguay), HBAP Sri Lanka Branch, The Hongkong and Shanghai Banking Corporation Limited – Philippine Branch, HSBC Investment and Insurance Brokerage, Philippines Inc, and HSBC FinTech Services (Shanghai) Company Limited and HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group (collectively, the “Distributors”) to their respective clients. This document or video is for general circulation and information purposes only.

The contents of this document or video may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document or video must not be distributed in any jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document or video will be the responsibility of the user and may lead to legal proceedings. The material contained in this document or video is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document or video may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HBAP and the Distributors do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document or video has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed are based on the HSBC Global Investment Committee at the time of preparation and are subject to change at any time. These views may not necessarily indicate HSBC Asset Management‘s current portfolios’ composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients’ objectives, risk preferences, time horizon, and market liquidity.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document or video is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Investments are subject to market risks, read all investment related documents carefully.

This document or video provides a high-level overview of the recent economic environment and has been prepared for information purposes only. The views presented are those of HBAP and are based on HBAP’s global views and may not necessarily align with the Distributors’ local views. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. It is not intended to provide and should not be relied on for accounting, legal or tax advice. Before you make any investment decision, you may wish to consult an independent financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you. You are advised to obtain appropriate professional advice where necessary.

The accuracy and/or completeness of any third-party information obtained from sources which we believe to be reliable might have not been independently verified, hence Customer must seek from several sources prior to making investment decision.

The following statement is only applicable to HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group with regard to how the publication is distributed to its customers: This publication is distributed by Wealth Insights of HSBC México, and its objective is for informational purposes only and should not be interpreted as an offer or invitation to buy or sell any security related to financial instruments, investments or other financial product. This communication is not intended to contain an exhaustive description of the considerations that may be important in making a decision to make any change and/or modification to any product, and what is contained or reflected in this report does not constitute, and is not intended to constitute, nor should it be construed as advice, investment advice or a recommendation, offer or solicitation to buy or sell any service, product, security, merchandise, currency or any other asset.

Receiving parties should not consider this document as a substitute for their own judgment. The past performance of the securities or financial instruments mentioned herein is not necessarily indicative of future results. All information, as well as prices indicated, are subject to change without prior notice; Wealth Insights of HSBC Mexico is not obliged to update or keep it current or to give any notification in the event that the information presented here undergoes any update or change. The securities and investment products described herein may not be suitable for sale in all jurisdictions or may not be suitable for some categories of investors.

The information contained in this communication is derived from a variety of sources deemed reliable; however, its accuracy or completeness cannot be guaranteed. HSBC México will not be responsible for any loss or damage of any kind that may arise from transmission errors, inaccuracies, omissions, changes in market factors or conditions, or any other circumstance beyond the control of HSBC. Different HSBC legal entities may carry out distribution of Wealth Insights internationally in accordance with local regulatory requirements.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada, Australia or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/ business. However, the Bank disclaims any guarantee on the management or operation performance of the trust business.

The following statement is only applicable to PT Bank HSBC Indonesia (“HBID”): PT Bank HSBC Indonesia (“HBID”) is licensed and supervised by Indonesia Financial Services Authority (“OJK”). Customer must understand that historical performance does not guarantee future performance. Investment product that are offered in HBID is third party products, HBID is a selling agent for third party product such as Mutual Fund and Bonds. HBID and HSBC Group (HSBC Holdings Plc and its subsidiaries and associates company or any of its branches) does not guarantee the underlying investment, principal or return on customer investment. Investment in Mutual Funds and Bonds is not covered by the deposit insurance program of the Indonesian Deposit Insurance Corporation (LPS).

Important information on ESG and sustainable investing

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information visit www.hsbc.com/sustainability.

In broad terms “ESG and sustainable investing” products include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors to varying degrees. Certain instruments we classify as sustainable may be in the process of changing to deliver sustainability outcomes. There is no guarantee that ESG and Sustainable investing products will produce returns similar to those which don’t consider these factors. ESG and Sustainable investing products may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for, ESG and Sustainable investing or the impact of ESG and Sustainable investing products. ESG and Sustainable investing and related impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the ESG / sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of ESG / sustainability impact will be achieved. ESG and Sustainable investing is an evolving area and new regulations are being developed which will affect how investments can be categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.

THE CONTENTS OF THIS DOCUMENT OR VIDEO HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN HONG KONG OR ANY OTHER JURISDICTION. YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE INVESTMENT AND THIS DOCUMENT OR VIDEO. IF YOU ARE IN DOUBT ABOUT ANY OF THE CONTENTS OF THIS DOCUMENT OR VIDEO, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

© Copyright 2024. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.