5 Oct 2023

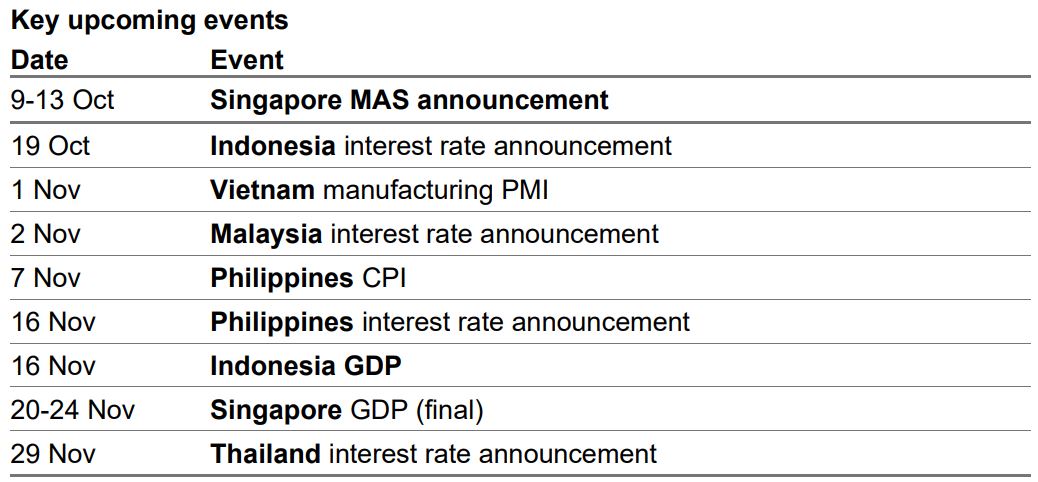

Indonesia, though feeling the pinch from lower commodity prices, has still seen growth perform better than expected so far this year. In turn, Bank Indonesia may have less leeway to ease policy as the Federal Reserve maintains a hawkish stance. With global trade in a slump, Singapore is inevitably exposed, though it is still expected to avoid a recession thanks to robust local demand. Vietnam, too, is feeling the drag from weaker export demand, although growth should pick up over the coming year as the government provides more support. In Thailand, the tourism boom has not been quite as ‘boomy’ as hoped so far, but visitor numbers should still improve and fiscal easing is likely to keep the Bank of Thailand on its toes. Similarly, in the Philippines, where growth has been sagging a little after a strong ‘re-opening’, another monetary tweak may be needed to deal with sticky prices. In Malaysia, by contrast, inflation remains steady, but weaker exports have lowered the ceiling on growth as well.

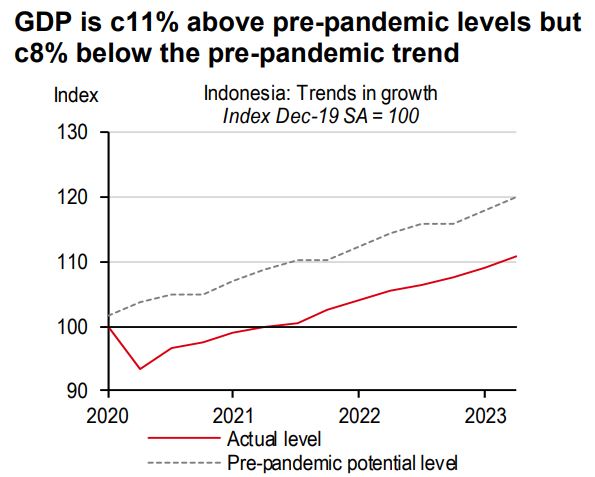

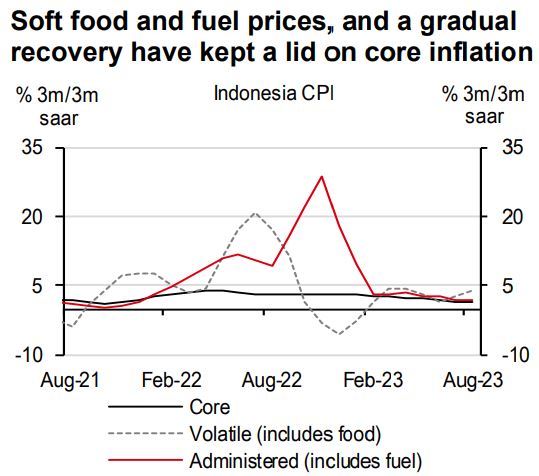

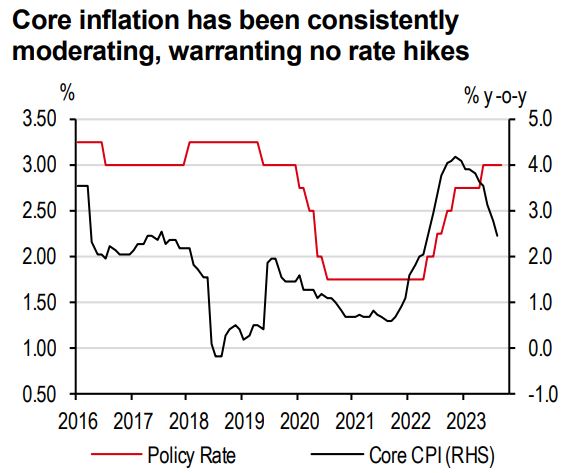

Indonesia has been an oasis of stability over the past few years, but an interesting divergence has cropped up recently. Since September 2022, Indonesia’s external balances have weakened, even as government balances remain strong and inflation looks benign.What’s driving this wedge, and on which side will the economy land?

The current account, net financial flows and the balance of payments swung into deficit in June 2023, led by a variety of factors – a 45-65% y-o-y fall in commodity prices of export items, such as coal and palm oil, a fall in export volumes, some rise in imports after a long gap, and weak inflows (both Foreign Direct Investment (FDI) and portfolio). In fact, we expect the current account to stay in deficit, resulting in a 0.6% of GDP deficit in 2023.

Meanwhile, the fiscal balance remains in surplus, led by strong tax revenues and contained expenditure. We believe tax policy changes in GST and income tax have led to the 1% of GDP higher tax revenues since 2019. The fall in material prices and lower subsidies have kept a lid on expenditure. The icing on the cake is broad-based demand for government bonds. Even the budget announced for 2024 has trodden the fine line between fiscal discipline and growth support.

Will external finances improve and join resilient fiscal finances? Or will fiscal finances worsen? A lot will depend on policy response. So far, the Bank of Indonesia (BI) has taken a slew of microeconomic steps to stabilise the IDR, ranging from buying/selling FX spot and forward, selling domestic non-deliverable forwards (D-NDFs), and running an FX term deposit facility. Most recently, BI announced the issuance of short-dated IDR bills called Bank Indonesia Rupiah Securities (SRBIs), which is likely to offer attractive rates, drawing in domestic and foreign investors. This is yet another instrument in BI’s toolkit to meet its twin objectives of FX and price stability. While micro steps are important, they can also come with side effects if used excessively. For instance, BI will have to carefully navigate the use of SRBI, ensuring that it does not distort the long end of the yield curve. And that is why micro steps should be complemented with macroeconomic actions, such as restrained monetary policy and fiscal stance.

True, growth may remain a tad subdued if policy is tight. But we are not concerned about this. We think Indonesia is an economy with tremendous medium-term growth potential as it climbs up the manufacturing value chain - from ores, to processed metals and EVs. We forecast Indonesia’s GDP to accelerate from 4.8% in 2023, to 5.0% in 2024 and 5.2% in 2025; a keen focus on macro stability now will be central to that.

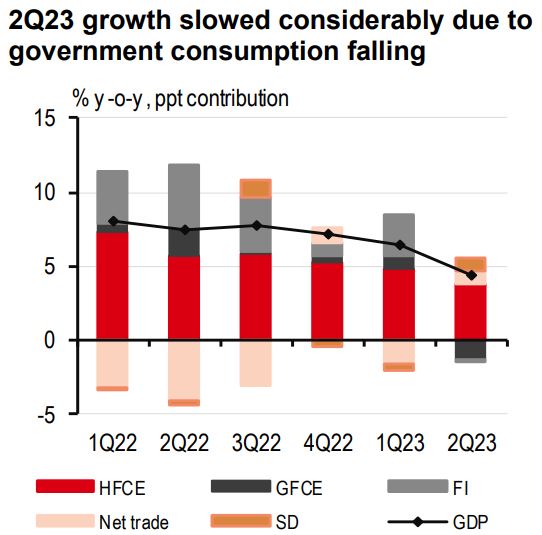

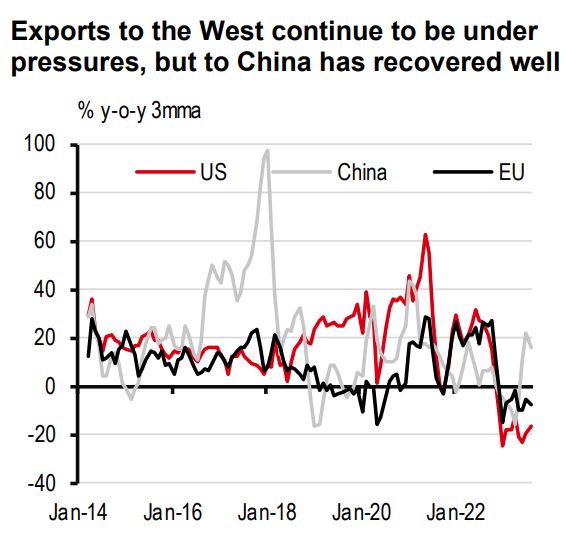

After the strong growth in 1Q23, external woes have started to weigh on Malaysia’s economy since 2Q. Indeed, growth decelerated to 2.9% y-o-y, delivering a big downside surprise to the market. Even with a relatively resilient trade sector, Malaysia is not insulated from a global trade downturn.

While the hit to Malaysia’s manufacturing has been delayed, its time has come. The sector barely grew in 2Q, and net exports also turned out to be a drag. This was not surprising, as Malaysia’s trade sector has started to face intensifying pressures due to a correction in global commodity prices and a sharp deceleration in its electronics shipments. In particular, China’s reopening did not lift its exports, with shipments to China declining by double-digits y-o-y.

That said, there remain pockets of resilience in Malaysia’s economy. Despite external weakness, domestic demand has remained resilient. Retail trade and consumer-oriented services continue to carry some momentum, thanks to an ongoing recovery in the job market. Meanwhile, Malaysia’s tourism sectors continue to provide strong support and is among the frontrunners in ASEAN in re-attracting Chinese visitors, approaching almost 50% of 2019 levels in May.

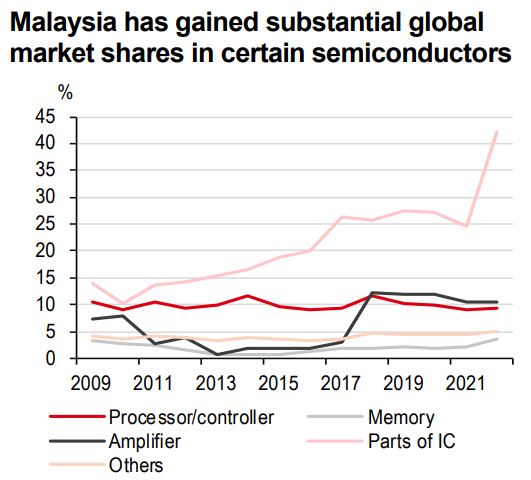

Even in the trade sector, semiconductors still show surprising resilience, as electronics shipments continued to grow 4% y-o-y on a 3-month-moving-average basis. The growth is due partly to Malaysia’s favourable position as an automotive chipmaker and partly to its substantial gains in market share in certain semiconductors over the years. This is most evident for particular parts of integrated circuits, whose global market share almost doubled to 45% in one year.

All in all, we recently cut our growth forecasts to 3.8% (from 4.3%) for 2023 and to 4.5% (from 4.7%) for 2024 to account for the underperformance in 2Q23 and a prolonged trade downturn.

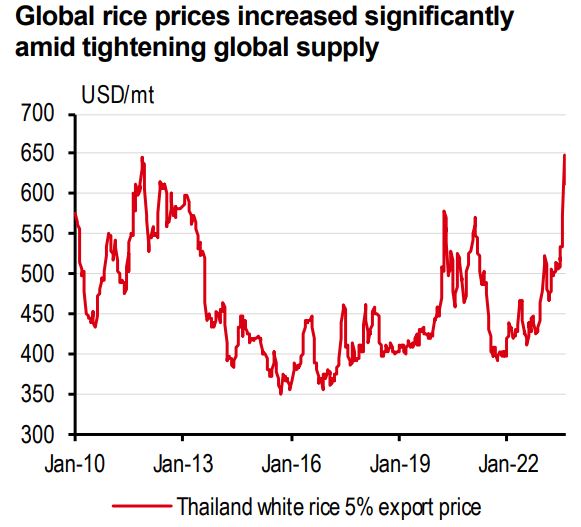

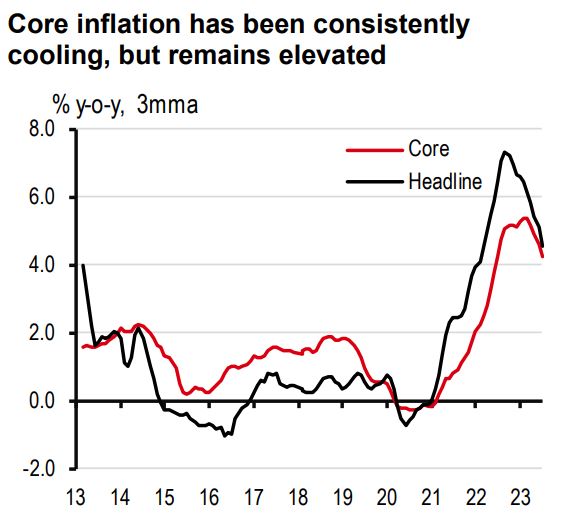

On the price front, Malaysia’s inflation has been consistently cooling, with broad-based decelerations. Core inflation has been moderating, though the pace is gradual. That being said, food inflation remains a worry, with risks stemming not only from El Niño, which could disrupt local food production, but also from Malaysia’s high reliance on imports of rice, whose global price has spiked of late. While we slightly trimmed our average headline inflation forecast to 2.8% (from 3.0%) recently, we maintained our core inflation forecast at 3.0%.

Despite the most aggressive series of rate hikes seen in ASEAN, monetary policy in the Philippines finds itself in a tough spot. After inflation eased for six straight months, the economy saw headline CPI flare up in August, directly after news that growth in 2Q23 (at 4.3% y-o-y) was the slowest GDP figure recorded since 2012, barring the COVID-19 pandemic. Given these intricacies, looking deeper into the details is key to gauge where the economy and monetary policy are headed.

The rise in headline CPI was largely a supply-side phenomenon. India’s restriction on many varieties of its rice exports saw rice export prices jump more than 20% in less than a month. This rocked the Philippine economy hard due to its position as the second-largest rice importer in the world; retail rice prices rose 27% while the food CPI rose 2% m-o-m. The good news is, core inflation continues to cool, implying that tight monetary stance is doing its job of reining in prices.

Monetary policy is also working its way in cooling the real economy. Gross fixed capital formation (GFCF) has been growing by double digits ever since the country embarked on an ambitious infrastructure agenda in 2016. However, in 2Q23, this growth driver lost steam and decelerated to just 3.9% y-o-y. Loan growth by big banks also eased to its slowest pace since the Global Financial Crisis (again, barring the COVID-19 pandemic). But the biggest contributor to the slowdown was government consumption. Operational and personnel spending eased partly due to the government’s effort to consolidate its fiscal resources and mostly due to underspending.

That being said, we argue that household consumption still needs to cool to help maintain balance in the economy. Growth in private consumption remained robust as households maintained a low saving rate to smooth out consumption amidst rising prices. This has resulted in a wider-than-usual deficit in trade, which in turn, puts significant pressure on the PHP. The USD-PHP has been testing the waters, floating just below the upper limit of the government’s FX assumption parameter of 57.

Unfortunately, food CPI is likely to continue rising amid higher global rice prices. To curb secondround effects, as well as to support the peso amidst the renewed strength in the USD, we recently changed our forecasts and now expect the Bangko Sentral ng Pilipinas (BSP) to hike further by 25bp to 6.50% in 4Q23. Due to a weak current account balance, we continue to expect the BSP to begin its easing cycle only after the US Federal reserve starts its own in 3Q24.

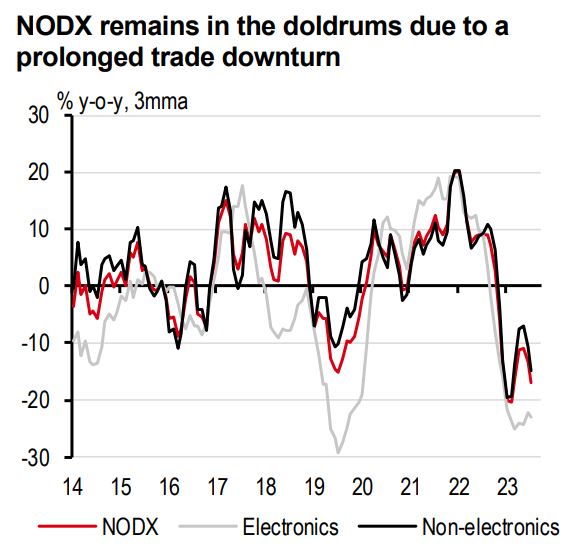

Singapore has narrowly avoided a technical recession in 2Q23 but its growth has slowed significantly, with a sequential expansion of only 0.1% q-o-q. The subdued GDP print reminds one of the challenges to Singapore’s economy, though a recession is not on the cards.

A severe global trade downturn remains the biggest drag on Singapore’s growth. Non-oil domestic exports (NODX) continued to plunge by double digits, with broad-based weakness. While there are some initial signs pointing to stabilisation in the tech cycle, tech-heavy economies have not yet seen a meaningful turnaround, but a bright spot in Singapore is its continued attractiveness for FDI, with a global share of 11% in 2022. Despite external weakness, pockets of resilience remain. Private consumption still shows some strength, thanks to the tight labour market. That being said, the labour market warrants a close watch, as it is showing initial signs of softening.

Meanwhile, Singapore’s travel-related services, which account for 10% of GDP, continue to show much-needed momentum. Unlike other sectors, Singapore’s transport and accommodation have not returned to pre-pandemic levels, suggesting further room to improve. Indeed, its visitors have recovered to 80% of 2019 levels, a similar recovery to regional peers. But Singapore has been leading the region in seeing a return of Chinese visitors, which have reached 60% of 2019 levels. This is thanks to Singapore’s efforts to push for direct flight restoration and also the fact that interest among Chinese business travellers are stronger than that of tourists to ASEAN.

We recently cut our 2023 growth forecast for Singapore to 1.2% (from 1.8%), expecting a longer trade downturn. That said, the ongoing recovery in the travel sectors should prevent a recession. In addition, inflation provides some relief for policymakers. Core inflation has been consistently cooling, but this is still well above the Monetary Authority of Singapore’s (MAS) comfort zone. We forecast core inflation at 4.1% for 2023, suggesting that, by the October meeting, the MAS will have to seek a delicate balance between subdued growth and elevated core inflation.

The fog thickened into the middle of 2023. The election season was nearing and back then, there was no clear winner in sight, leading to much policy uncertainty and concern over political stability. But market participants were not overly concerned. We believed that amidst the uncertainty and tepid global economic environment, 2023 would be the year Thailand would grow robustly. At the centre of this expectation was a strong recovery in tourism, driven by a resurgence of its largest group of visitors, the Chinese. It turns out, not only were Chinese tourists slow to return, but goods demand from mainland China has also been weaker than last year. All in all, the Thai economy is missing the “China-lift” needed to stage a strong recovery and growth significantly surprised on the downside in 2Q23. We recently cut our full-year 2023 growth forecast to 3.1% (from 3.7%).

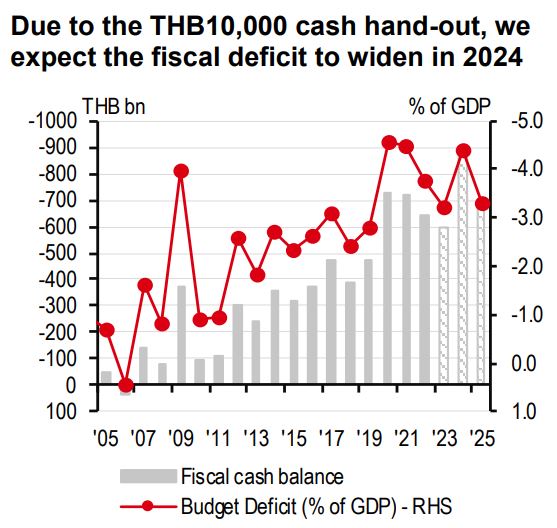

However, we expect full-year 2024 growth to remain punchy at 4.2%. The 4-month political impasse is finally over and the newly elected Prime Minister, Srettha Thavisin, has laid out his economic plans for the economy until 2H24. At the core of his economic blueprint is a THB10,000 digital cash handout to all Thai citizens aged 16 and above in the hope of raising Thailand’s consumption, a narrative that is challenged by high household debt and an ageing population. This is not cheap though. According to the authorities, the project will cost THB560bn or c3.0% of GDP. A fiscal stimulus of this size is likely to not only boost growth but also stoke inflationary concerns.

Speaking of inflation, price pressures are also coming from quite an unusual culprit – rice. Due to India’s recent restrictions on its rice exports, rice export prices have risen by more than 20%. This isn’t usually a concern in Thailand, given that it is the second largest rice exporter in the world. But with the largest supplier out, domestic rice prices in Thailand followed global forces, rising 33% since mid-August. If this increase is sustained, headline CPI inflation should increase by around 1.3ppt.

In anticipation of these inflationary risks and pressures, the Bank of Thailand (BoT) hiked its policy rate by 25bp to 2.50% in September. We think this was the last rate hike in the BoT’s tightening cycle – one that has lasted 16 months. We expect the BoT to keep its policy rate steady at 2.50% even throughout 2025.

After half a year, external risks are not dissipating. Vietnam’s growth slowed significantly to below 4% in 1H23, less than half of its impressive growth in 2022. The good news is that the economic conditions have not deteriorated, but the recovery pace looks to be gradual.

As in many export-oriented economies, sluggish external demand remains the main challenge for Vietnam. Exports have not stopped falling in 3Q, though the pace is much smaller than the double-digit decline in 1H. Encouragingly, there are some pockets of resilience.

Despite a protracted downturn in the tech cycle, Vietnam’s computer-related electronics shipments have surprisingly turned to growth recently. Meanwhile, its agricultural exports have seen double-digit growth, thanks largely to a boost from China’s demand. However, their 25% share in the export basket is unable to provide a meaningful lift to total exports. After all, the broad global trade downturn persists.

Despite the ongoing external drag, Vietnam’s FDI prospects remain intact. Greenfield FDI rose 40% y-o-y in the first eight months of 2023, with manufacturing alone accounting for 85% of new FDI. In particular, new FDI into manufacturing year-to-date has surprisingly exceeded that for the whole year in each of the past three years. While a trade downturn persists in the near term, the trend provides hopes for Vietnam to see a strong rebound when the cycle turns. That said, the timing may come later than our original estimate, given uncertainty in the global economy.

All in all, we recently maintained our 2023 growth forecast at 5.0%, but trimmed our 2024 growth forecast to 6.3% (from 6.7%), taking into account a prolonged trade downturn.

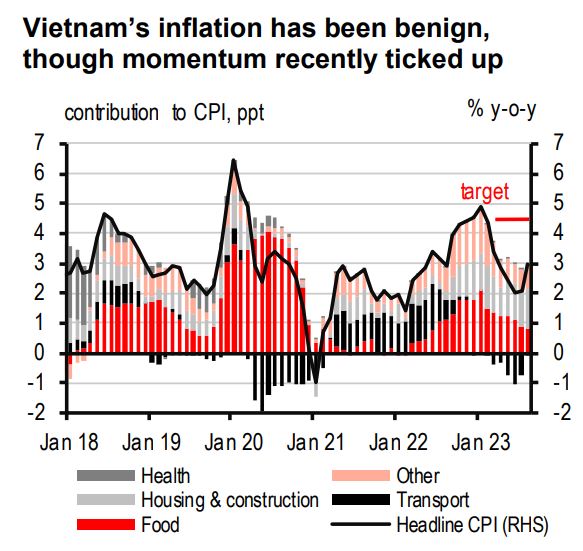

Elsewhere, inflation has consistently been cooling, providing some relief for policymakers. That being said, the recent tick-up in momentum from higher food and energy prices warrants a close watch. Thus, we upgraded our inflation forecasts to 3.2% (from 2.6%) in 2023 and 3.1% (from 2.6%) in 2024.

Additional disclosures

1. This report is dated as at 06 July 2023

2. All market data included in this report are dated as at close 05 July 2023, unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (200801006421 (807705-X)), The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch, HSBC Private Bank (Suisse) SA, HSBC Private Bank (Suisse) SA DIFC Branch, HSBC Private Bank Suisse SA, South Africa Representative Office, HSBC Financial Services (Lebanon) SAL, HSBC Private banking (Luxembourg) SA and The Hongkong and Shanghai Banking Corporation Limited (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/business. However, the Bank disclaims any guaranty on the management or operation performance of the trust business.

The following statement is only applicable to by HSBC Bank Australia with regard to how the publication is distributed to its customers: This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

Mainland China

In mainland China, this document is distributed by HSBC Bank (China) Company Limited (“HBCN”) and HSBC FinTech Services (Shanghai) Company Limited to its customers for general reference only. This document is not, and is not intended to be, for the purpose of providing securities and futures investment advisory services or financial information services, or promoting or selling any wealth management product. This document provides all content and information solely on an "as-is/as-available" basis. You SHOULD consult your own professional adviser if you have any questions regarding this document.

The material contained in this document is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HSBC India does not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Investments are subject to market risk, read all investment related documents carefully.

© Copyright 2025. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Important information on sustainable investing

“Sustainable investments” include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors (collectively, “sustainability”) to varying degrees. Certain instruments we include within this category may be in the process of changing to deliver sustainability outcomes.

There is no guarantee that sustainable investments will produce returns similar to those which don’t consider these factors. Sustainable investments may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for sustainable investments, or the impact of sustainable investments (“sustainability impact”). Sustainable investment and sustainability impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and/or reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of sustainability impact will be achieved.

Sustainable investing is an evolving area and new regulations may come into effect which may affect how an investment is categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.