4 Jul 2024

Growth in Indonesia remains soft, amid tight fiscal policy and high interest rates. Macroprudential easing, however, has lifted credit growth, which should support demand. Thailand should see a growth pick-up as fiscal spending has been turned back on and tourists are beginning to return. Malaysia’s exports have lagged the region, but there are signs of a turn, while foreign direct investment (FDI) keeps pouring in. Singapore is still grappling with sticky price pressures, but growth has cooled sufficiently to tame inflation over time. The Philippines continues to impress with its growth resilience, with cooling inflation, and a pick-up in FDI inflows pointing to further demand gains. Vietnam is over its growth dip of the past year, with local demand steadying and the export recovery slated to broaden out.

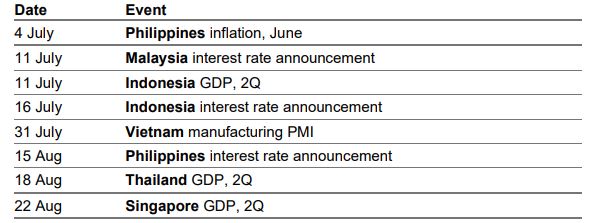

Key upcoming events

Following the elections on 14 February, the General Election Commission (KPU) announced on 20 March that Prabowo Subianto has won an outright majority, garnering 58.6% of the votes, and is set to be Indonesia’s next president. All eyes are now on the key people and policies the new government champions. The continued presence of technocrats in key ministerial posts would signal a desire to push ahead with reforms, and the final legislative count will determine the parliamentary muscle behind potential reforms.

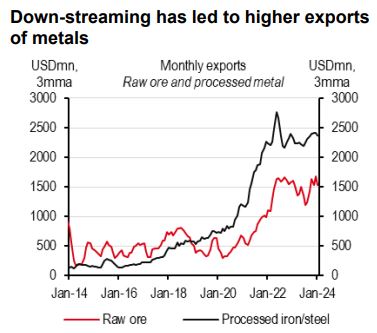

Prabowo has spoken at length about continuing Jokowi’s reforms – embarking on downstreaming 2.0, and continuing the infrastructure build-out. However, we believe there will be challenges along the way: for instance, slower global demand for nickel EV batteries, lowering Indonesia’s carbon footprint, and restructuring certain SOEs. Prabowo has outlined plans to upgrade defence systems and enhance social welfare schemes (in particular a new free lunch programme for schools). The challenge here would be to keep a lid on the fiscal deficit, and hold on to Indonesia’s well-maintained macro stability over the next five years.

We do believe that a decade of reforms has put in place several buffers, which would help keep the house in order, at least over the short term. For instance, better infrastructure and lower logistics costs should keep a lid on core inflation, as has been clear in recent months. Supply-side reforms could help control the rise in food inflation. And rising exports of processed metals should keep the external deficits manageable.

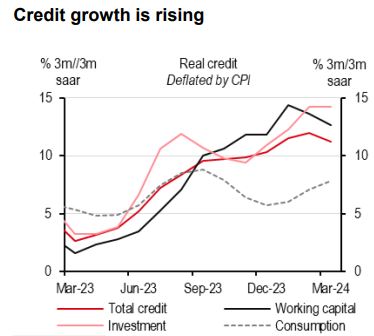

Growth is likely to be higher in the post-election period, led by: (1) a positive fiscal impulse, (2) the realisation of FDI inflows waiting on the sidelines for election-related uncertainties to end, and (3) a recent rise in capacity utilisation and credit growth. The latter, in particular, has been rising across the board, and may get a shot in the arm when Bank Indonesia (BI) embarks on monetary policy easing. We expect GDP growth to come in higher in 2024 (5.2% vs 5% in 2023).

Moving to the medium term, we believe Indonesia is one of the economies where the next decade’s growth is likely to be higher than the previous decade’s growth, as the economy climbs up the manufacturing value chain: from ores to processed metals and electric vehicles (EVs). In fact, we forecast that potential growth will accelerate by 0.5ppt over the medium term, rising from 5.3% in the period before the pandemic to 5.8% by 2028.

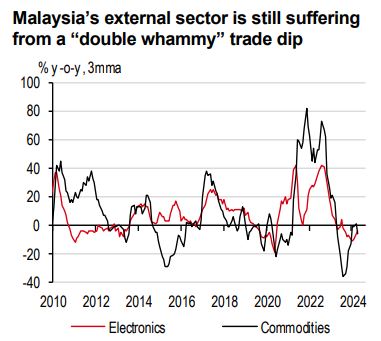

After a few quarters of lacklustre data, Malaysia started 2024 with encouraging signs of an economic recovery. 1Q24 GDP growth accelerated to 4.2% y-o-y, beating market expectations. While the recovery is still nascent, it nonetheless signals a positive picture of Malaysia’s economic rebound.

Similar to its export-oriented peers, the trade downturn significantly weighed on Malaysia’s growth in 2023. Fortunately, the worst has passed. The pillar manufacturing sector finally turned to growth after three quarters of disappointing performance. Indeed, the turn in external demand has fuelled 1Q GDP. That being said, Malaysia is not out of the woods yet, as its flagship electronics sector is still waiting anxiously for a meaningful pick-up. The good news is that semiconductor industrial production (IP) has started to improve, although it remains in contraction.

While waiting for manufacturing to regain its swagger, Malaysia’s services remain more than resilient. Despite fading re-opening tailwinds, there continues to be decent growth in consumeroriented and tourism-related sectors. The former still enjoys the ongoing recovery in the labour market and generous support, although subsidy rationalisation has started in June to reduce longterm fiscal burdens. The tourism sector likely provided much-needed support to growth, despite no release of 2024 tourism data. Malaysia is likely to be one of the main beneficiaries in ASEAN of an influx of Chinese visitors after the introduction of visa-free schemes. A proxy indicator of direct flight restoration with China already signals a recovery rate exceeding 90% of pre-pandemic levels.

All in all, we forecast GDP growth 4.5% for 2024, accounting for a gradual turnaround in the trade cycle and additional boost from the tourism sector.

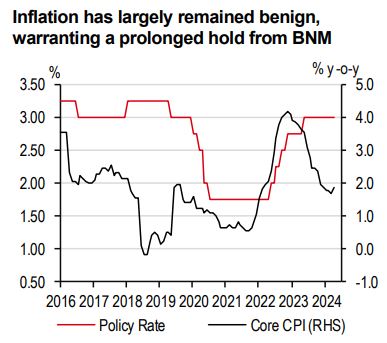

Meanwhile, inflation remains largely in check. Headline inflation cooled from 2.5% y-o-y on average in 2023 to only 1.7% in the first four months of 2024. Quite positively, the impact of elevated global rice prices has been partially blunted, with food inflation down to 2% y-o-y. That being said, upside risks to inflation remain, particularly after the implementation of targeted diesel subsidies from June. Given the recent development, we upgraded our inflation forecast to 2.7% for 2024 (previously 2.2%) and 3.0% for 2025 (previously 2.3%), but there is a degree of uncertainty, pending the details of the subsidy rationalisation on RON95 fuel.

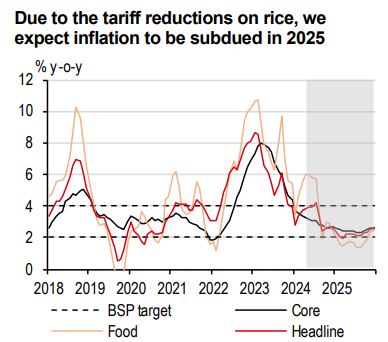

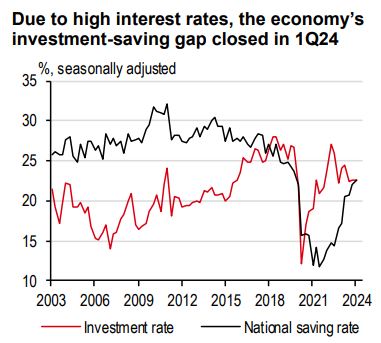

All things considered, the Philippine economy is doing well, but things could get even better. Yes, growth surprised – marginally – on the downside in 1Q24 at 5.7% y-o-y. But we think this dip in domestic demand was necessary to guide the economy back to balance and re-anchor inflation expectations to within the Bangko Sentral ng Pilipinas’ (BSP) 2-4% target band. The national saving rate has improved, enough to close the economy’s investment-saving gap. For the same reason, the economy’s current account deficit is narrowing faster than expected – a testament that the economy is relying less on foreign capital today than in 2022 when the peso weakened to a historical low against the USD. Inflation, too, has been surprising on the downside throughout the first half of the year and is likely to continue to do so (after a short uptick) with the government set to slash the tariff rates on rice to 15% (from 35%). We estimate this will reduce inflation by as much as 1.8ppt. This will increase the Philippines’ real policy rates, incentivising capital to remain within the country’s borders.

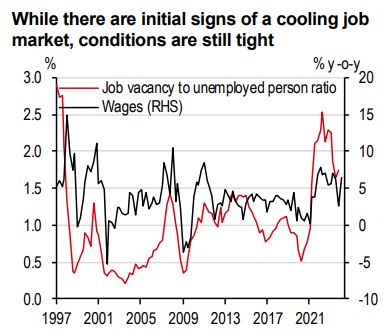

And yet, amidst all these adjustments, growth remained intact. An economy usually slows when it is building back up its savings. But the Philippines bucked this trend. The unemployment rate remains at historical lows, showcasing the country’s main driver of growth: its people. In fact, despite high inflation, Filipino consumers are still shifting their preferences from purchasing ‘essential’ goods, to ‘non-essential’ goods and services.

The BSP, however, surprised many during the last rate-setting meeting. It said it is mulling the possibility of cutting its policy rate ahead of the Fed. It has been a view long-held by many, including HSBC, that the BSP will only cut after the Fed. So when the BSP made the remark, the market reacted and the USD-PHP went up to as high as 58.8, the second highest level in history.

Although the current account and the real policy rate have improved back to pre-pandemic levels, we think these indicators would have to perform even better for the BSP to have ample room to cut ahead of the Fed. That being said, we maintain our view that the BSP will only cut after the Fed. Since we expect the Fed to begin its easing cycle in September this year, we expect the BSP to make its first 25bp rate cut in 4Q24 wherein the year-end policy rate will be 6.25%. But when inflation drops due to the tariff rate cuts, the room to cut faster than the Fed will open.

Singapore has finally seen some green shoots materialising. Despite a small downside surprise, its growth accelerated to 2.7% y-o-y in 1Q24, the fastest pace in 18 months.

While the manufacturing sector suffered from a one-off correction in 1Q24, Singapore has largely benefitted from an improving trade cycle, particularly in the electronics sector. After 16 months of outright y-o-y declines, semiconductor non-oil domestic exports (NODX) momentum turned positive.

But Singapore’s growth is not limited to just the trade recovery. Its services sector has remained more than resilient, thanks to a rapid pick-up in visitors. Despite being the last ASEAN country to introduce a visa-free scheme for Chinese tourists, Singapore reaped imminent benefits, now attracting Chinese visitors equivalent to 80% of 2019 levels.

All in all, we kept our growth forecasts unchanged at 2.4% for 2024, expecting an ongoing recovery in the tech-led global trade cycle and continued resilience in travel-related services.

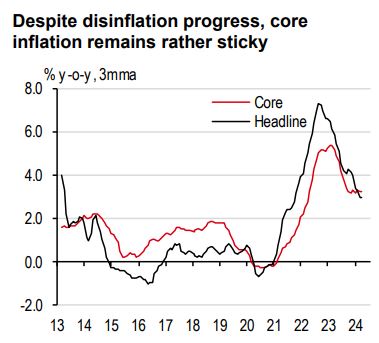

Despite better growth prospects, the disinflation progress has been more halting. Core inflation remained flat at 3.2% y-o-y in the first four months of 2024, acutely reminding one that the ‘last mile’ of disinflation is difficult to achieve. But Singapore’s story is not quite the same as the US case.

Singapore’s core inflation includes energy. Fuel and utilities costs have been ticking up again since 1Q24. This is exacerbated by a five-fold increase in the carbon tax to USD25/tonne this year. Both electricity and water tariffs have increased further in 2Q24, pushing up inflation momentum.

Apart from “Singapore exceptionalism” in the definition, part of the elevated core inflation is an acute reflection of the stickiness in services. This is particularly the case in those sectors that have imbalances in labour availability, which resembles developments in the US.

While the disinflationary forces continue, the pace is likely to be rather slow. Overall, we maintain our average core inflation forecast at 3.1% for 2024 and 2.2% for 2025.

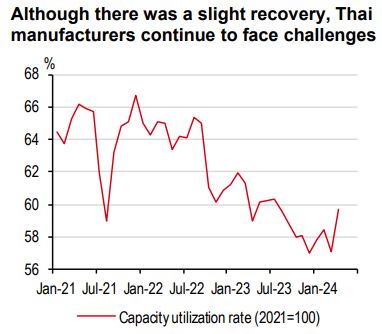

Thai GDP has been a story of growth drivers or, more precisely, the lack thereof. Mid-2023, growth surprised on the downside. Mainland Chinese tourists, Thailand’s biggest market for visitors, did not return as fast as many had hoped for, requiring many forecasters to slash their growth estimates. By end-2023, the result was the same, but the cause was different. The delayed formation of the government led to the delayed passage of the FY24 budget (which started in 4Q23). Thailand’s fiscal engine was absent, and growth in 4Q23 decelerated to 1.7% y-o-y. 1Q24 was even more dismal. The fiscal engine was still down but Thailand’s export engine continued to sputter as manufacturers face increasing competition from mainland China. Growth slowed further to 1.5% y-o-y, but at least it was above the Bank of Thailand’s (BoT) bearish expectation of just 1.0% y-o-y. To the surprise of many, private consumption and investment remained robust, putting a floor under how much growth could slow.

We do think the Thai economy has finally turned for the better with more growth drivers finally up and running. Private demand remains strong despite the BoT’s decade-high policy rate. The recovery in tourism is exceeding expectations, thanks to a growing intra-ASEAN market. The fiscal engines are also finally churning. After six months of delay, the FY24 budget was passed and the ‘catch-up’ spending in the remaining two quarters of the fiscal year will eventually boost growth. However, the extent of the recovery is likely to be limited, with Thailand’s export engine still looking for its spark. All in all, we think the worst is finally over.

With the growth outlook improving (but still below trend), we think the BoT has more legroom to keep its policy rate steady at 2.50% up to 2025. This is to help guide the economy’s much needed deleveraging cycle, particularly in household debt. The BoT already specified the goal: the household debt ratio will need to go down to 80% of GDP. It is now at 91%.

Although the growth outlook may have turned, there are blindsides. Policy uncertainty still lingers with the Digital Wallet Scheme still subject to debate in parliament – more so with the Constitutional Court deciding whether to suspend the Prime Minister or not on charges over appointments (Bloomberg, 23 May 2024). The internal selection of the Senate is also ongoing, with no clear view of what the likely outcome will be.

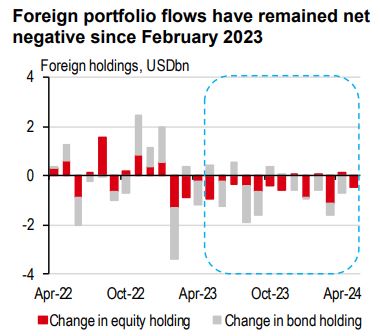

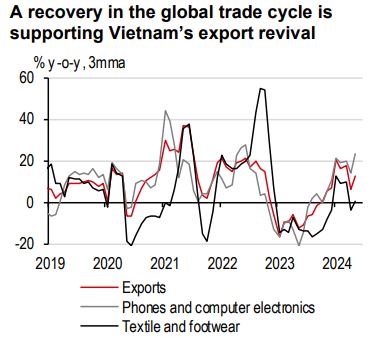

After seeing slow growth, the worst appears to have passed for Vietnam. Despite disappointing the market slightly, growth in 1Q24 accelerated to 5.7% y-o-y from 5.1% in 2023. While high frequency indicators suggest a sustained rebound, the recovery is quite uneven.

Fortunately, the external-facing manufacturing sector continues to regain strength. Export growth jumped by double-digits, largely driven by an upturn in the electronics cycle, particularly benefitting from Samsung’s encouraging pre-sale performance. However, certain shipments, including textiles and footwear, have been facing some pressures amid the Red Sea disruptions. To achieve stronger growth in the export cycle, a broad-based recovery across major sectors is required. But leading indicators, including the PMI, suggest a positive direction. In particular, long-term business interest also shows few signs of slowing. Foreign Direct Investment (FDI) remains well on track to sustain the momentum seen in 2023, with new FDI growing at a double-digit pace y-t-d.

But the domestic sector saw some softening. Despite decent growth since the start of this year, retail sales are still almost 10% lower than what the trend growth would suggest. On the tourism front, Vietnam has seen good progress in attracting international visitors. While its annual target of 17-18m tourists for this year looks well within reach, Vietnam is facing intense competition from regional peers who have introduced more visa-free schemes.

All in all, we tweaked our quarterly profile, but maintained our GDP growth forecast at 6.0% for 2024 and 6.5% for 2025.

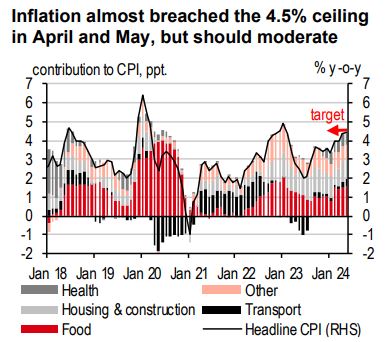

Meanwhile, inflation creeped up close to the State Bank of Vietnam’s (SBV) target ceiling of 4.5% in April and May. But this was not entirely surprising, as unfavourable base effects are largely at play. In fact, inflation came in lower than our forecasts in 2Q24. Despite lingering upside risks to inflation from food and commodity prices, we trim our 2024 inflation forecast to 3.6% (previously 3.9%) and keep our 2025 inflation forecast at 3.0%.

Additional disclosures

1. This report is dated as at 28 June 2024.

2. All market data included in this report are dated as at close 28 June 2024, unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Bank Canada, HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (200801006421 (807705-X)), The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch, HSBC Private Bank (Suisse) SA, HSBC Private Bank (Suisse) SA DIFC Branch, HSBC Private Bank Suisse SA, South Africa Representative Office, HSBC Financial Services (Lebanon) SAL, HSBC Private banking (Luxembourg) SA and The Hongkong and Shanghai Banking Corporation Limited (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/business. However, the Bank disclaims any guaranty on the management or operation performance of the trust business.

The following statement is only applicable to by HSBC Bank Australia with regard to how the publication is distributed to its customers: This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada, Australia or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

Mainland China

In mainland China, this document is distributed by HSBC Bank (China) Company Limited (“HBCN”) and HSBC FinTech Services (Shanghai) Company Limited to its customers for general reference only. This document is not, and is not intended to be, for the purpose of providing securities and futures investment advisory services or financial information services, or promoting or selling any wealth management product. This document provides all content and information solely on an "as-is/as-available" basis. You SHOULD consult your own professional adviser if you have any questions regarding this document.

The material contained in this document is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HSBC India does not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Investments are subject to market risk, read all investment related documents carefully.

© Copyright 2024. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Important information on sustainable investing

“Sustainable investments” include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors (collectively, “sustainability”) to varying degrees. Certain instruments we include within this category may be in the process of changing to deliver sustainability outcomes.

There is no guarantee that sustainable investments will produce returns similar to those which don’t consider these factors. Sustainable investments may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for sustainable investments, or the impact of sustainable investments (“sustainability impact”). Sustainable investment and sustainability impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and/or reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of sustainability impact will be achieved.

Sustainable investing is an evolving area and new regulations may come into effect which may affect how an investment is categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.